- Foreign exchange market. Asian session: the euro edged up

Market news

Foreign exchange market. Asian session: the euro edged up

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

05:00 Japan Leading Economic Index (Finally) November 104.2 103.9 103.5

05:00 Japan Coincident Index (Finally) November 113.3 116.6 111.9

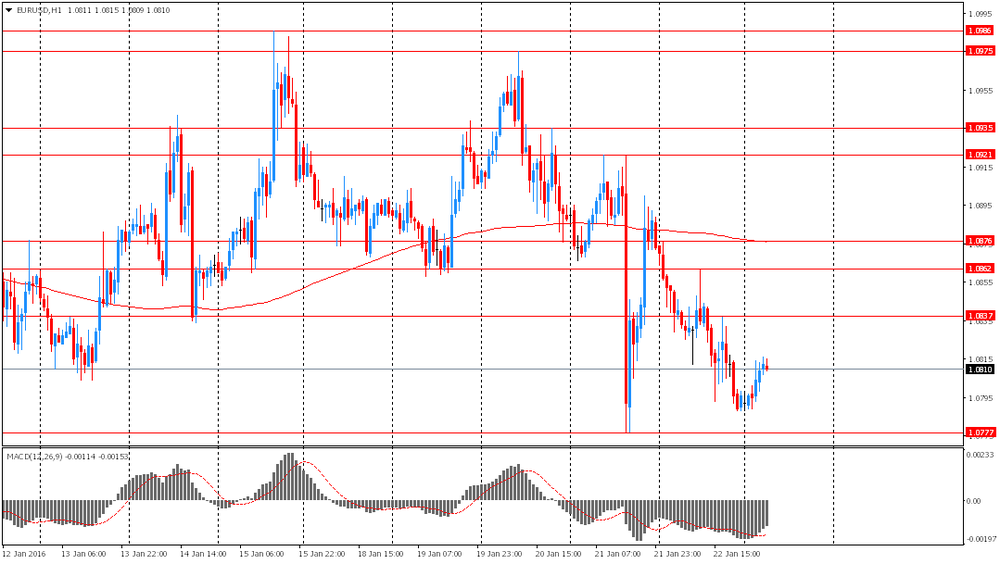

The euro edged up against the U.S. dollar after Friday's decline, which was triggered by higher risk sentiment. This week investors are waiting for euro zone inflation data. Consumer prices are expected to have risen by 0.4% y/y in January after a 0.2% increase in December. Higher inflation would relief ECB policymakers, because they had to use unconventional tools to make inflation start growing towards the target level of just under 2%.

France, Spain and Belgium will release their fourth quarter GDP reports. These data will help market participants assess strength of the euro zone economy.

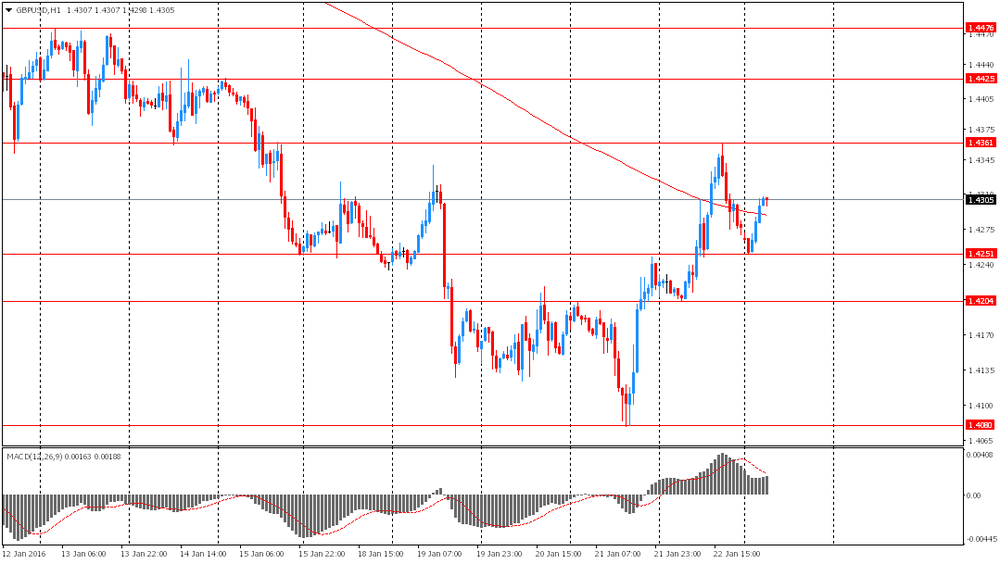

The pound climbed ahead of U.K. GDP data. Analysts surveyed by the Wall Street Journal forecast the country's GDP had grown by 0.5% compared to the same period last year after posting growth of 0.4% in the third quarter. If data meet expectations this would mean that the U.K. economy has partly recovered in the last quarter of 2015.

The Australian dollar slightly declined amid a disappointing report on business conditions from the National Australia Bank. The corresponding index declined to 7 in December from 10 in November. Meanwhile the business confidence index fell to 3 from 5.

EUR/USD: the pair rose to $1.0815 in Asian trade

USD/JPY: the pair traded within Y118.40-85

GBP/USD: the pair rose to $1.4305

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Germany IFO - Business Climate January 108.7 108.4

09:00 Germany IFO - Current Assessment January 112.8 112.8

09:00 Germany IFO - Expectations January 104.7 104.1

11:00 Germany Bundesbank Monthly Report

14:00 Belgium Business Climate January -1.4 -1.7

18:00 Eurozone ECB President Mario Draghi Speaks