- Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the release of the Bank of England's interest rate decision

Market news

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the release of the Bank of England's interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:15 U.S. FOMC Member Rosengren Speaks

08:00 Eurozone ECB President Mario Draghi Speaks

08:30 United Kingdom Halifax house price index January 2% Revised From 1.7% 0.3% 1.7%

08:30 United Kingdom Halifax house price index 3m Y/Y January 9.5% 9.7%

09:00 Eurozone ECB Economic Bulletin

12:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5% 0.5%

12:00 United Kingdom Bank of England Minutes

12:00 United Kingdom Asset Purchase Facility 375 375 375

12:00 United Kingdom BOE Inflation Letter

12:45 United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar traded lower against the most major currencies ahead of the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to increase by 2,000 to 280,000 last week.

Preliminary productivity in the U.S. non-farm businesses is expected to decline at a 1.8% annual rate in the fourth quarter, after a 2.2% rise in the third quarter.

Preliminary unit labour costs are expected to increase 3.9% in the fourth quarter, after a 1.8 gain in the third quarter.

The U.S. factory orders are expected to decline 2.8% in December, after a 0.2% rise in November.

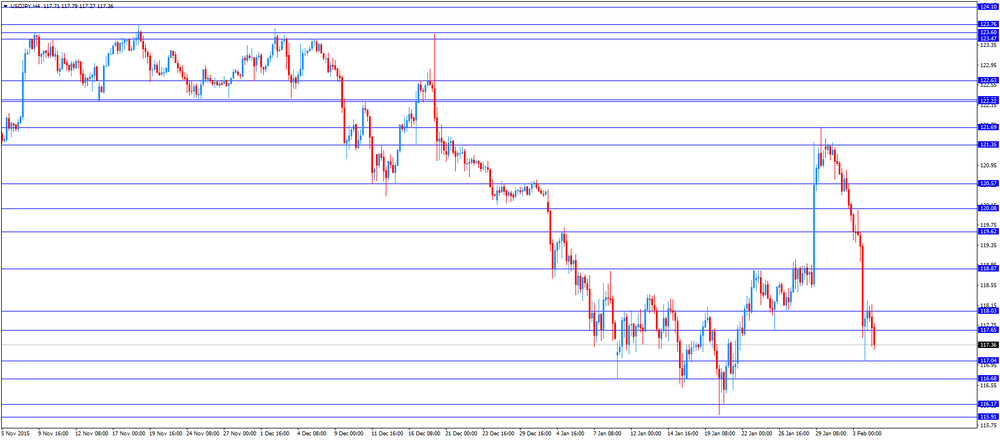

The U.S. dollar was under pressure due to yesterday's comments by New York Fed President William Dudley. He said in an interview with MNI that financial conditions were tighter than in December, and a stronger U.S. dollar could have "significant consequences" for the U.S. economy. He pointed out that the Fed would have to take that into consideration making its decision at its March monetary policy meeting.

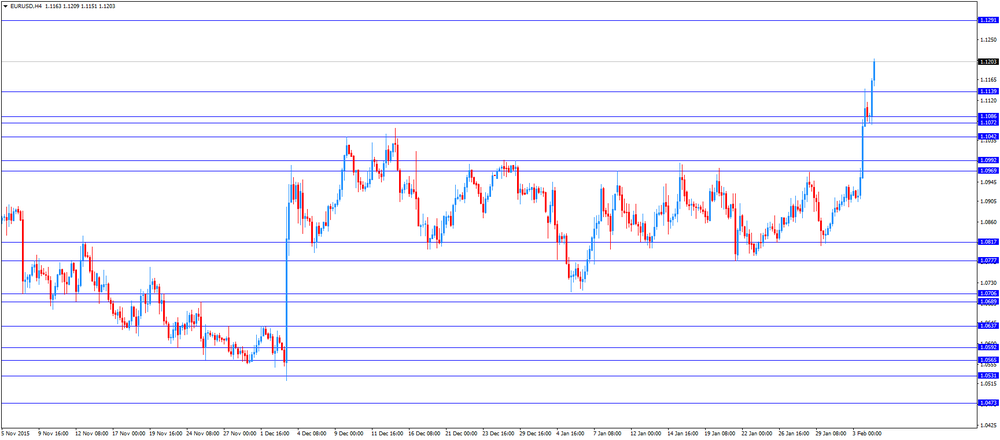

The euro traded higher against the U.S. dollar on a weaker U.S. dollar as market participants speculate that the Fed will delay further interest rate hikes.

The European Union (EU) Commission released it economic growth and inflation forecasts for the Eurozone on Thursday. Eurozone's economic growth for 2016 was cut to 1.7%, down from the previous estimate of 1.7%. Eurozone's economic growth for 2017 remained unchanged at 1.9%.

The EU Commission noted that there are risks to the outlook from the slowdown in emerging countries and possible further interest rate hikes in the U.S.

The EU commission lowered its 2016 inflation forecast for the Eurozone to 0.5% from 1.0%. Inflation is expected to be 1.5% in 2017.

According to the EU commission, inflation was driven by further drop in oil prices, but it was only temporary.

The European Central Bank (ECB) President Mario Draghi said in a speech on Thursday that it is better to act earlier than too late as the risks are too high.

"Adopting a wait-and-see attitude and extending the policy horizon brings with it risks: namely a lasting de-anchoring of expectations leading to persistently weaker inflation. And if that were to happen, we would need a much more accommodative monetary policy to reverse it. Seen from that perspective, the risks of acting too late outweigh the risks of acting too early," he said.

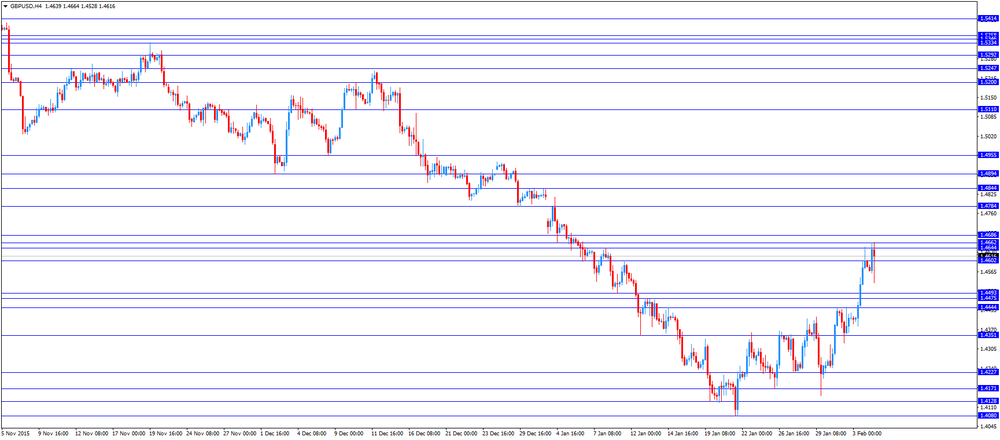

The British pound traded lower against the U.S. dollar after the release of the Bank of England's (BoE) interest rate decision. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The Bank of England's Monetary Policy Committee (MPC) released its February meeting minutes today. All members voted to keep the central bank's monetary policy unchanged.

The central bank downgraded its growth forecasts. The economy is expected to expand 2.2% in 2016, down from its previous forecast of a 2.5% rise, and 2.3% in 2017, down from its previous forecast of a 2.6% gain.

EUR/USD: the currency pair rose to $1.1209

GBP/USD: the currency pair decreased to $1.4528

USD/JPY: the currency pair fell to Y117.27

The most important news that are expected (GMT0):

13:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter IV 1.8% 3.9%

13:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter IV 2.2% -1.8%

13:30 U.S. Initial Jobless Claims January 278 280

15:00 U.S. Factory Orders December -0.2% -2.8%