- Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the mixed economic data from the Eurozone

Market news

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Current Account, bln Quarter IV -18.8 Revised From -18.1 -20 -21.1

00:30 Australia Building Permits, m/m January 8.6% Revised From 9.2% -2% -7.5%

01:00 China Manufacturing PMI February 49.4 49.3 49.0

01:00 China Non-Manufacturing PMI February 53.5 52.7

01:35 Japan Manufacturing PMI (Finally) February 52.3 52.1

01:45 China Markit/Caixin Manufacturing PMI February 48.4 48.0

03:30 Australia Announcement of the RBA decision on the discount rate 2% 2% 2%

03:30 Australia RBA Rate Statement

08:15 Switzerland Retail Sales (MoM) January 1.1% -0.3%

08:15 Switzerland Retail Sales Y/Y January -1.7% Revised From -1.6% -1.2% 0.2%

08:30 Switzerland Manufacturing PMI February 50 49.6 51.6

08:50 France Manufacturing PMI (Finally) February 50 50.3 50.2

08:55 Germany Unemployment Rate s.a. February 6.2% 6.2% 6.2%

08:55 Germany Unemployment Change February -20 -10 -10

08:55 Germany Manufacturing PMI (Finally) February 52.3 50.2 50.5

09:00 Eurozone Manufacturing PMI (Finally) February 52.3 51 51.2

09:30 United Kingdom Purchasing Manager Index Manufacturing February 52.9 52.2 50.8

10:00 Eurozone Unemployment Rate January 10.4% 10.4% 10.3%

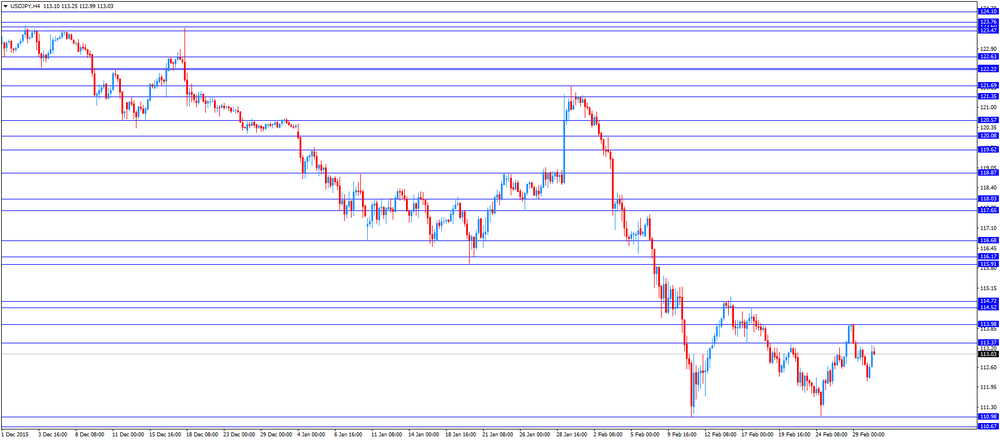

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The final manufacturing purchasing managers' index is expected to decline to 51.0 in February from 52.4 in January.

The ISM manufacturing purchasing managers' index is expected to rise to 48.5 in February from 48.2 in January.

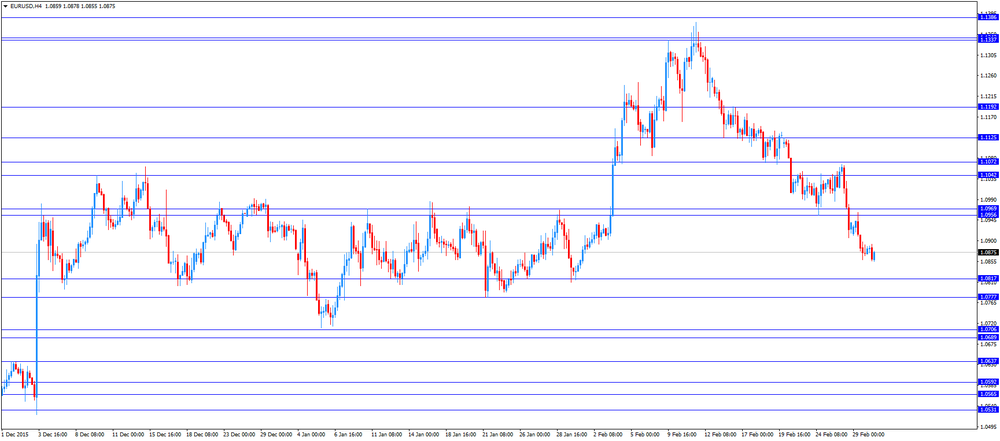

The euro traded mixed against the U.S. dollar after the release of the mixed economic data from the Eurozone. Eurostat released its unemployment data for the Eurozone on Tuesday. Eurozone's unemployment rate declined to 10.3% in January from 10.4% in December. It was the lowest reading since August 2011. Analysts had expected the unemployment rate to remain unchanged at 10.4%.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Tuesday. Eurozone's final manufacturing purchasing managers' index (PMI) dropped to 51.2 in February from 52.3 in January, up from the preliminary reading of 51.0.

The drop was driven by a softer growth in production, new orders, export business and employment.

"With factory output in the Eurozone showing the smallest rise for a year in February, concerns are growing that the region is facing yet another year of sluggish growth in 2016, or even another downturn," Chris Williamson, Chief Economist at Markit said.

"With all indicators - from output and demand to employment and prices - turning down, the survey will add pressure on the ECB to act quickly and aggressively to avert another economic downturn," he added.

Germany's final Markit/BME manufacturing PMI fell to 50.5 in February from 52.3 in January, up from the preliminary reading of 50.2. The index was driven by declines in all subindexes.

France's final manufacturing PMI increased to 50.2 in February from 50.0 in January, down from the preliminary reading of 50.3. The index was driven by a rise in backlogs of work.

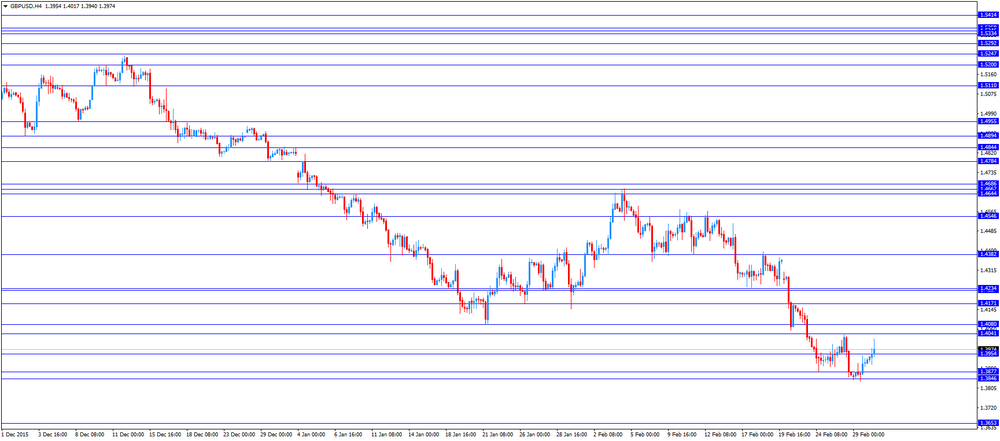

The British pound traded higher against the U.S. dollar after the release of the U.K. manufacturing PMI data. Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Tuesday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. decreased to 50.8 in February from 52.9 in January, missing expectations for a fall to 52.2. it was the lowest level since April 2013.

The decrease was driven by a drop in output.

"The near-stagnation of manufacturing highlights the ongoing fragility of the economic recovery at the start of the year and provides further cover for the Bank of England's increasingly dovish stance. The breadth of the slowdown is especially worrisome," Markit's Senior Economist Rob Dobson said.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the Canadian GDP data. Canada's GDP growth is expected to rise 0.1% in December, after a 0.3% gain in November.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair increased to $1.4017

USD/JPY: the currency pair rose to Y113.33

The most important news that are expected (GMT0):

13:30 Canada GDP (m/m) December 0.3% 0.1%

13:30 Canada GDP QoQ Quarter IV 0.6%

13:30 Canada GDP (YoY) Quarter IV 2.3% 0%

14:45 U.S. Manufacturing PMI (Finally) February 52.4 51

15:00 U.S. Construction Spending, m/m January 0.1% 0.4%

15:00 U.S. ISM Manufacturing February 48.2 48.5