- Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the weak economic data from the Eurozone

Market news

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the weak economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Gross Domestic Product (QoQ) Quarter IV 1.1% Revised From 0.9% 0.5% 0.6%

00:30 Australia Gross Domestic Product (YoY) Quarter IV 2.7% Revised From 2.5% 2.6% 3.0%

06:45 Switzerland Gross Domestic Product (YoY) Quarter IV 0.8% 0.1% 0.4%

06:45 Switzerland Gross Domestic Product (QoQ) Quarter IV -0.1% Revised From 0% 0.2% 0.4%

09:30 United Kingdom PMI Construction February 55 55.5 54.2

10:00 Eurozone Producer Price Index, MoM January -0.8% -0.7% -1.0%

10:00 Eurozone Producer Price Index (YoY) January -3.0% -2.9% -2.9%

10:00 United Kingdom MPC Member Dr Ben Broadbent Speaks

12:00 U.S. MBA Mortgage Applications February -4.3% -4.8%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. According to the ADP employment report, the U.S. economy is expected to add 190,000 jobs in February.

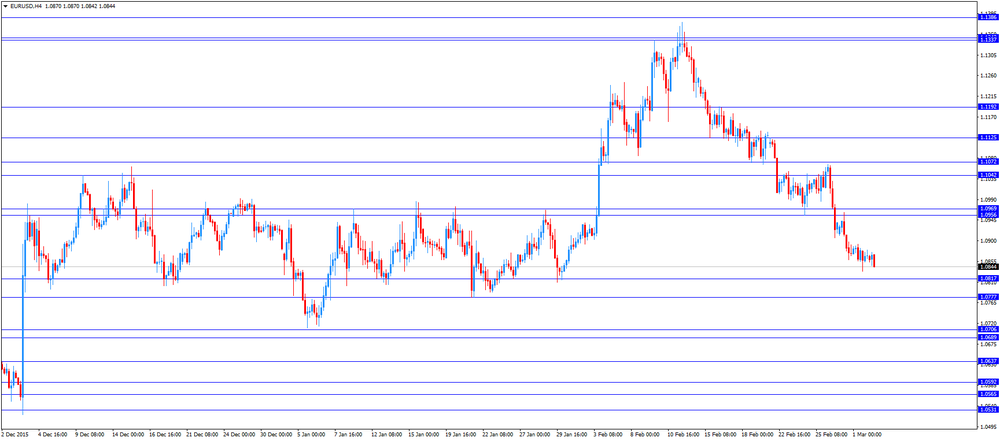

The euro traded lower against the U.S. dollar after the release of the weak economic data from the Eurozone. Eurostat released its producer price index for the Eurozone on Wednesday. Eurozone's producer price index declined 1.0% in January, missing expectations for a 0.7% fall, after a 0.8% decrease in December.

Intermediate goods prices fell 0.3% in January, capital goods prices rose 0.1%, non-durable consumer goods prices were flat and durable consumer goods prices were up 0.4%, while energy prices decreased 3.2%.

On a yearly basis, Eurozone's producer price index dropped 2.9% in January, in line with expectations, after a 3.0% fall in December.

Eurozone's producer prices excluding energy fell 0.6% year-on-year in January. Energy prices dropped at an annual rate of 8.6%.

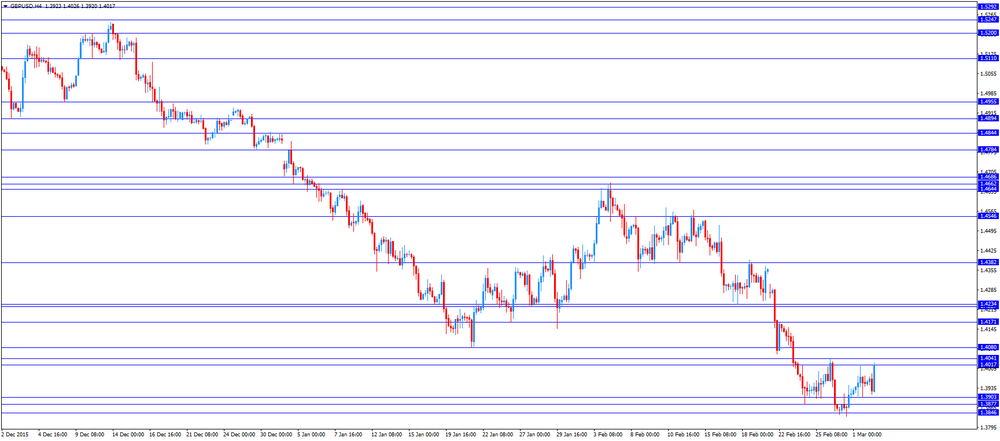

The British pound traded higher against the U.S. dollar despite the release of the weaker-than-expected U.K. construction PMI data. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. declined to 54.2 in February from 55.0 in January, missing expectations for an increase to 55.5. It was the lowest level since April 2015.

A reading above 50 indicates expansion in the construction sector.

The index was driven by a softer growth in output, new orders and employment. Housing activity showed the slowest performance since June 2013.

The Swiss franc traded mixed against the U.S. dollar. The State Secretariat for Economic Affairs (SECO) released its gross domestic product (GDP) data for Switzerland on Wednesday. Switzerland's GDP rose 0.4% in the fourth quarter, exceeding expectations for a 0.2% rise, after a 0.1% decrease in the third quarter.

GDP was driven by a positive contribution from household and public spending.

On a yearly basis, Switzerland's economy grew at 0.4% in the fourth quarter, exceeding expectations for a 0.1% rise, after a 0.8% increase in the third quarter.

In 2015 as whole, the Swiss economy expanded 0.9%, after a 1.9% growth in 2014.

EUR/USD: the currency pair fell to $1.0842

GBP/USD: the currency pair increased to $1.4026

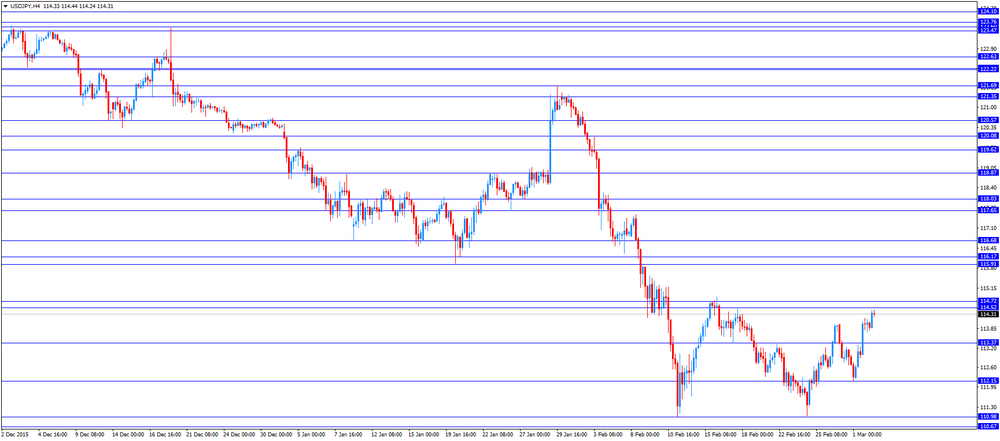

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:15 U.S. ADP Employment Report February 205 190

14:00 United Kingdom BOE Deputy Governor for Financial Stability Jon Cunliffe speaks

15:30 U.S. Crude Oil Inventories February 3.502 3.5

19:00 U.S. Fed's Beige Book