- Asian session: The yen fell

Market news

Asian session: The yen fell

The yen fell against all its major counterparts as improving U.S. economic data and a recovery in oil prices damped demand for safer assets. The currency approached the weakest level in two weeks against the greenback as Japanese shares advanced for a third day following gains in U.S. equities on Wednesday. The yen has still strengthened at least 2 percent versus all of its 16 major peers this year as concern China's economy is slowing roiled financial markets around the world. Demand for higher-yielding assets rose after a report on U.S. payrolls showed companies added more workers last month than economists projected. The U.S. will release monthly employment data Friday.

The Australian dollar rose for a fourth day against the greenback as oil climbed toward $35 a barrel and iron-ore futures on the Dalian Commodity Exchange traded at an eight-month high. Investors had shunned the currency as anxiety over China's ability to manage a slowing economy clouded the outlook for global growth, casting doubts on the Fed's ability to add to its December rate increase.

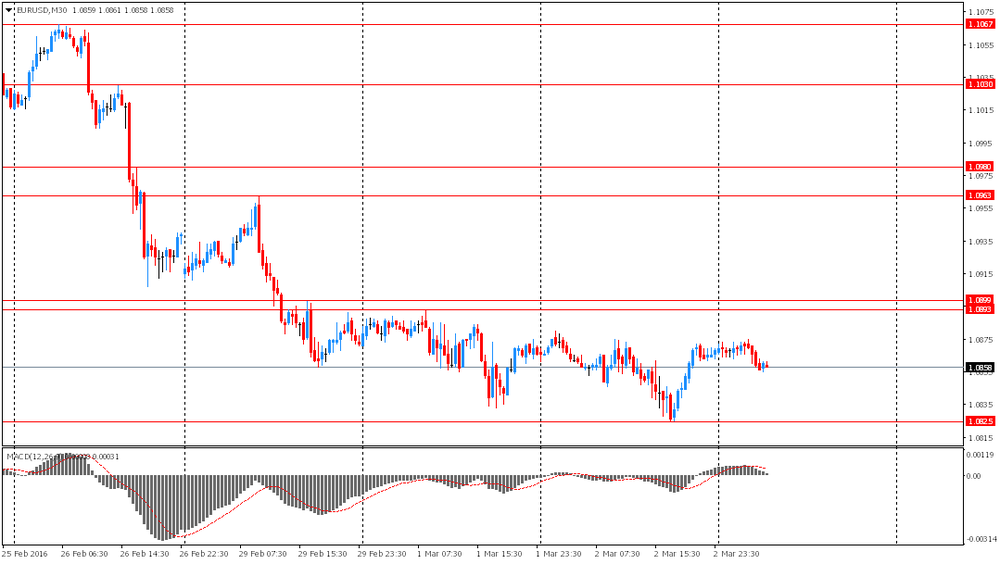

EUR / USD: during the Asian session, the pair was trading in the $ 1.0855-75

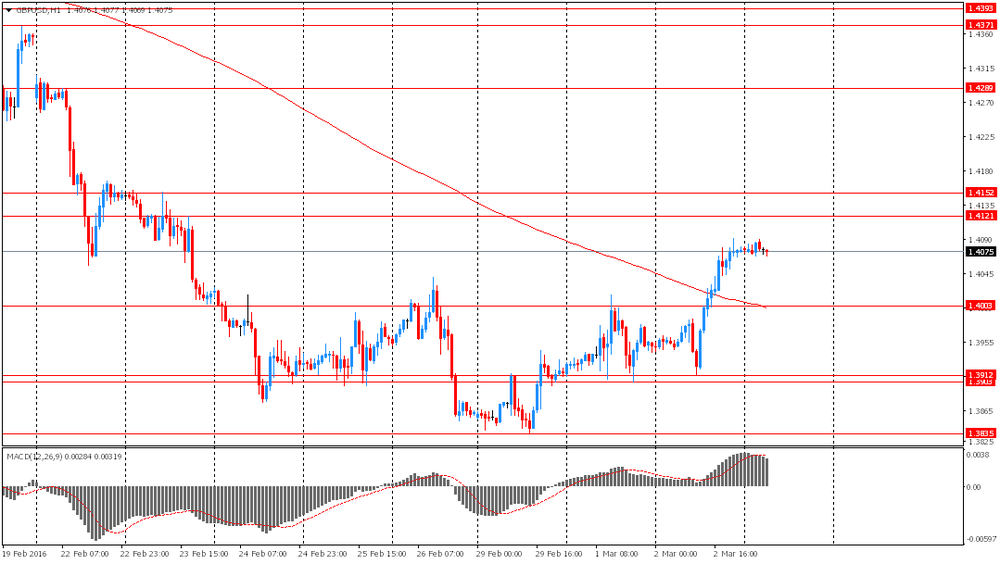

GBP / USD: during the Asian session, the pair was trading in the $ 1.4070-90

USD / JPY: during the Asian session, the pair rose to Y114.25

Moving back to the markets we have a busy data calendar today with UK services PMI the key release this morning given that sector's large impact on GDP.