- Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the ECB’s interest rate decision

Market news

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the ECB’s interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Consumer Inflation Expectation 3.6% 3.4%

01:30 China PPI y/y February -5.3% -4.9% -4.9%

01:30 China CPI y/y February 1.8% 1.9% 2.3%

06:30 France Non-Farm Payrolls (Finally) Quarter IV 0.1% Revised From 0% 0.2% 0.2%

07:00 Germany Current Account January 26.3 Revised From 25.6 13.2

07:00 Germany Trade Balance (non s.a.), bln January 19.0 Revised From 18.8 13.6

07:45 France Industrial Production, m/m January -0.6% Revised From -1.6% 0.8% 1.3%

07:45 France Industrial Production, y/y January 2.0% 1.9%

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05% 0.00%

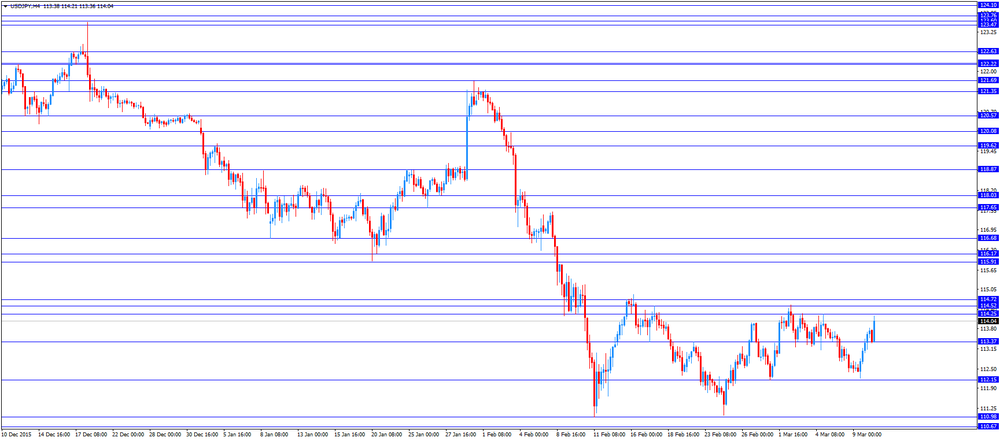

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. initial jobless claims data. The number of initial jobless claims in the U.S. is expected to decline by 3,000 to 275,000 last week.

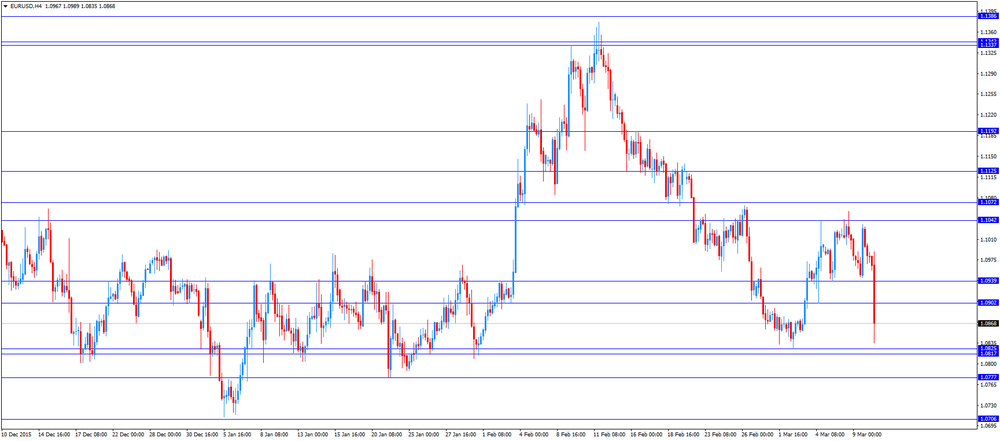

The euro traded lower against the U.S. dollar after the release of the European Central Bank's (ECB) interest rate decision. The central bank cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3%. The ECB also expanded its monthly purchases to €80 billion from €60 billion.

A press conference is scheduled to be at 13:30 GMT.

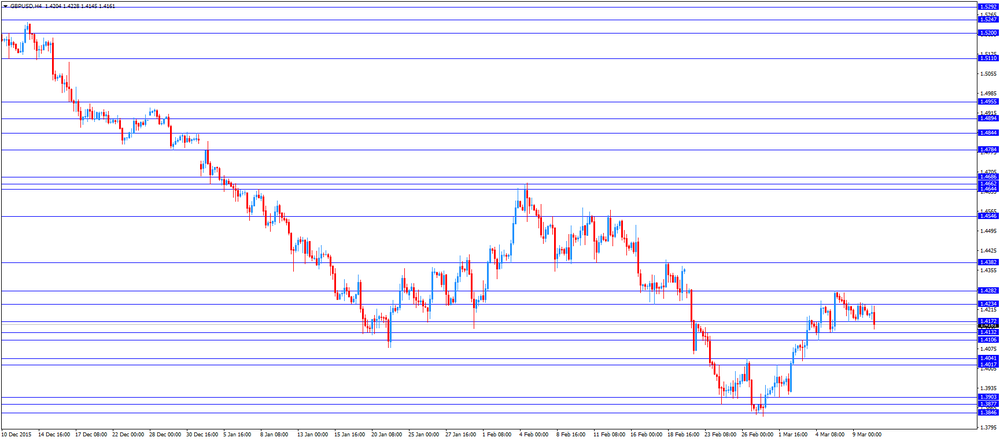

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

Britain's Prime Minister David Cameron will warn on Thursday that Britain's exit from the European Union (Brexit) would weigh on the pound.

"It means pressure on the pound sterling. It means jobs being lost. It means mortgage rates might rise. It means businesses closing. It means hardworking people losing their livelihoods," he will say according to extracts of his speech reported in local media.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the Canadian economic data. Canada's new housing price index is expected to rise 0.2% in January, after a 0.1% gain in December.

The Canadian capacity utilization rate is expected to decrease 81.6% in the fourth quarter from 82.0% in the third quarter.

EUR/USD: the currency pair declined to $1.0835

GBP/USD: the currency pair fell to $1.4145

USD/JPY: the currency pair rose to Y114.21

The most important news that are expected (GMT0):

13:30 Eurozone ECB Press Conference

13:30 Canada New Housing Price Index, MoM January 0.1% 0.2%

13:30 U.S. Initial Jobless Claims March 278 275

21:15 Canada BOC Gov Stephen Poloz Speaks

21:45 New Zealand Business NZ PMI February 57.9

23:50 Japan BSI Manufacturing Index Quarter I 3.8 4.2