- Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the weaker-than-expected industrial production data from the Eurozone

Market news

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the weaker-than-expected industrial production data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence April -2.2% -4.0%

02:00 China Trade Balance, bln March 32.59 30.85 29.86

09:00 Eurozone Industrial production, (MoM) February 1.9% Revised From 2.1% -0.7% -0.8%

09:00 Eurozone Industrial Production (YoY) February 2.9% Revised From 2.8% 1.2% 0.8%

11:00 U.S. MBA Mortgage Applications April 2.7% 10%

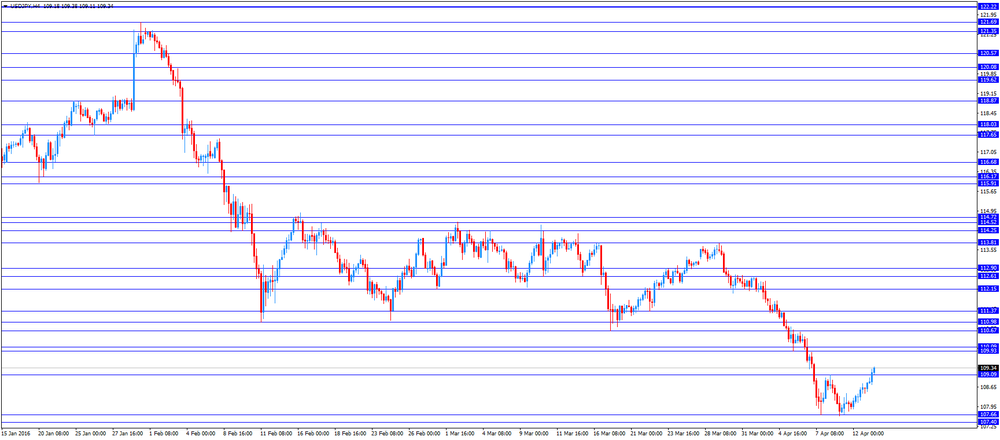

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the U.S. economic data. The U.S. retail sales are expected to rise 0.1% in March, after a 0.1% decline in February.

The U.S. PPI is expected to increase 0.2% in March, after a 0.2% drop in February.

The U.S. producer price inflation excluding food and energy is expected to rise 0.1% in March, after a flat reading in February.

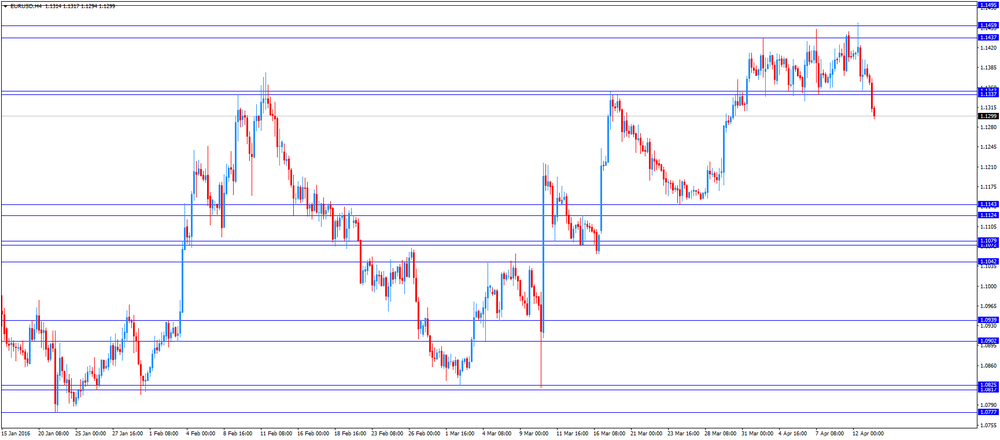

The euro traded lower against the U.S. dollar after the release of the weaker-than-expected industrial production data from the Eurozone. Eurostat released its industrial production data for the Eurozone on Wednesday. Industrial production in the Eurozone fell 0.8% in February, missing expectations for a 0.7% decrease, after a 1.9% rise in January. January's figure was revised down from a 2.1% increase.

Non-durable consumer goods output dropped 1.8% in February, capital goods output decreased 0.3%, while energy output fell 1.2%. Intermediate goods output were flat in February, while durable consumer goods declined 0.4%.

On a yearly basis, Eurozone's industrial production rise 0.8% in February, missing expectations for a 1.2% rise, after a 2.9% increase in January. January's figure was revised up from a 2.8% gain.

Durable consumer goods climbed by 0.8% in February from a year ago, capital goods rose by 3.0%, non-durable consumer goods gained by 0.7%, while intermediate goods output increased by 1.9%. Energy output declined by 5.2% in February from a year ago.

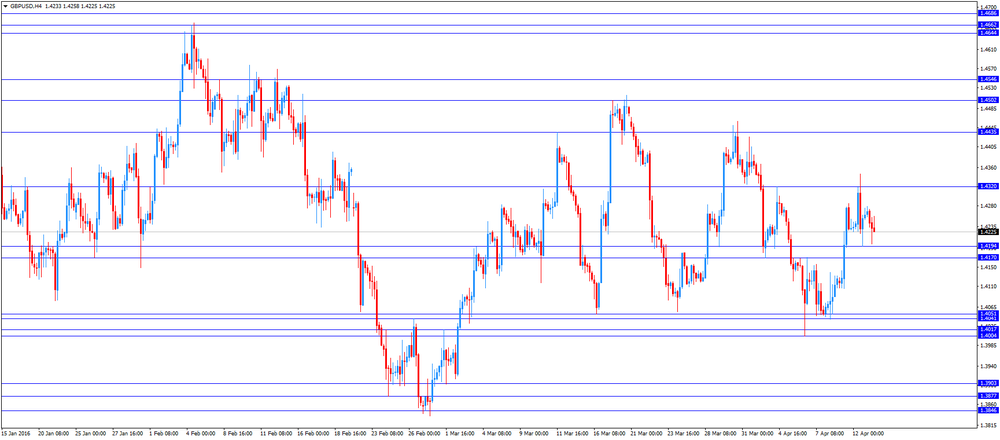

The British pound traded mixed against the U.S. dollar in the absence of any major economic data from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Bank of Canada's interest rate decision. The central bank is expected to keep its interest rate unchanged.

EUR/USD: the currency pair declined to $1.1294

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y109.38

The most important news that are expected (GMT0):

12:30 U.S. PPI, m/m March -0.2% 0.2%

12:30 U.S. PPI, y/y March 0% 0.3%

12:30 U.S. PPI excluding food and energy, m/m March 0.0% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y March 1.2% 1.3%

12:30 U.S. Retail sales March -0.1% 0.1%

12:30 U.S. Retail Sales YoY March 3.1%

12:30 U.S. Retail sales excluding auto March -0.1% 0.5%

14:00 Canada Bank of Canada Rate 0.5% 0.50%

14:00 Canada Bank of Canada Monetary Policy Report

14:00 Canada BOC Rate Statement

14:00 U.S. Business inventories February 0.1% -0.1%

14:30 U.S. Crude Oil Inventories April -4.937 2.85

15:15 Canada BOC Press Conference

18:00 U.S. Fed's Beige Book

22:30 New Zealand Business NZ PMI March 56.0