- Gold price gains momentum

Market news

Gold price gains momentum

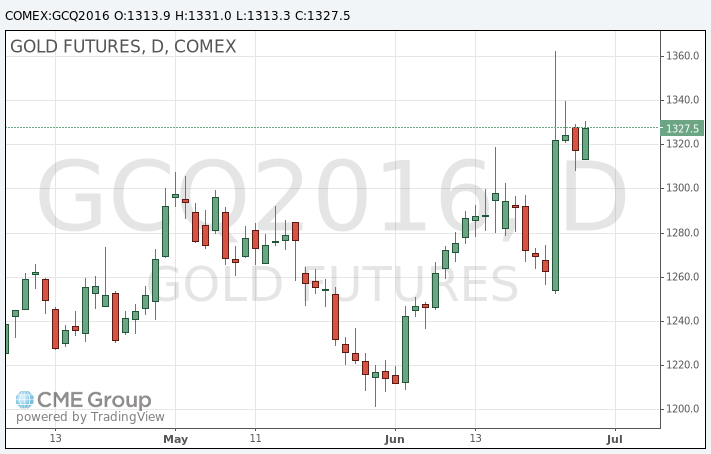

Gold prices rose in today's trading, rebounding from losses, as market players excluded further increase in interest rates this year after Britain voted in favor of withdrawal from the European Union.

According Fed Watch CME, the chance of a rate increase in July is estimated at 0%, and the probability of lowering rate is estimated at 5%. A cut in September has 10.5%.

On Tuesday, Fed policy maker Jerome Powell said that Brexit shifted the global risks to the economic slowdown, which could pose a threat to the forecast of the US central bank.

News raised fears that other countries may also withdraw from the block, and global growth will be under considerable pressure, while the actual British EU exit timing remain unclear.

At the moment, the precious metal rose in price by almost 25% for the year, helped by concerns about global growth and the introduction of negative interest rates by central banks worldwide.

The cost of the August gold futures on the COMEX rose to $ 1331.0 per ounce.