- AUD: to underperform vs USD, JPY, CHF; Fade data-driven rallies - ANZ

Market news

AUD: to underperform vs USD, JPY, CHF; Fade data-driven rallies - ANZ

eFX news with the latest ANZ recommendation:

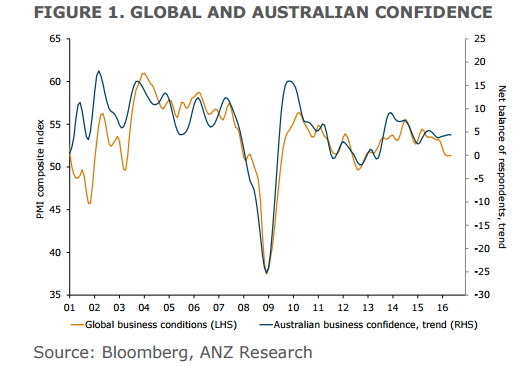

Brexit is now a reality. The damage is done and we now have to navigate through an environment of heightened uncertainty. Though the UK is far away, this kind of global uncertainty is never a good thing for global confidence or risk appetite. By extension, as a small, open economy dependent on global trade and funding, the AUD should weaken in this environment. We expect the AUD to underperform safe havens such as the USD, JPY and the CHF. The AUD is likely to remain within our existing forecast range (above USD0.66).

Increased pricing of RBA rate cuts has also contributed to the weakness in the AUD. Since the Brexit vote, rates markets have added 20bps of rate cuts and now expect ~40bps of easing. This looks fully priced and as such domestic factors will take a backseat for now

For the AUD, we would fade better-than-expected data although worse-than-expected data may see markets reinforce expectations of near-term RBA easing and see the AUD trade lower. Brexit also raises questions about the medium-term outlook for the Australian economy and in turn, the AUD. Australia has benefited from a globalised economy, with free trade and capital mobility at its centre. While Brexit is not sufficient to declare that globalisation has peaked, the global economic model is clearly under pressure. A continued trend towards less international cooperation would justify a bigger premium on AUD assets and weigh on the AUD.