- Gold price little changed for the day

Market news

Gold price little changed for the day

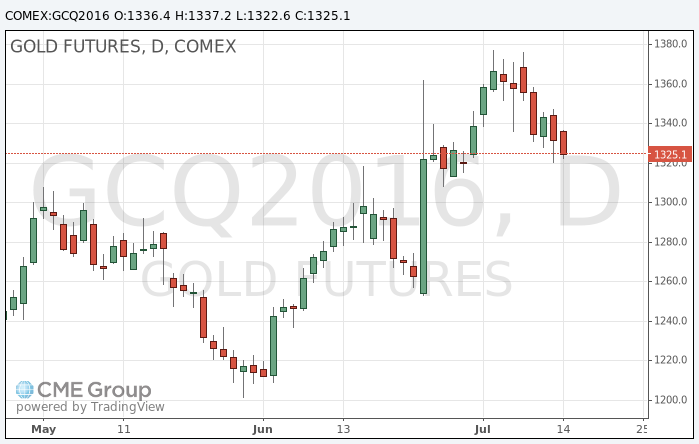

Gold becomes moderatly cheaper in the course of today's trading, and preparing to finish in the red the first week of the last seven against the backdrop of improving risk appetite and strengthening of the dollar.

Asian stock markets rose to an eight-month high after encouraging data from China, while European shares fell after the attack in the south of France, which killed 84 people.

After six weeks of growth, the longest rally since March 2014, gold have fallen by 2.5 percent since the beginning of this week after strong data on new jobs in non-agricultural sector of the US and reduced risks about Brexit.

"Investors are taking profits, and now $ 1,300 is a new level of support for gold prices, - said a senior strategist at ING Bank Hamza Khan -. Wider political events such as elections in the US, followed by the French and German elections next year, will be enough to support gold, even if other assets will rise in value in a low interest rate and the search for yield. "

The dollar is preparing to finish the week gaining more than 5 percent against the yen.

Three Fed officials on Thursday said that should not rush to increase US interest rates, in spite of signs that the US economy has reached almost full employment.

The assets of the world's largest gold exchange-traded fund SPDR Gold Trust fell 0.25 percent to 962.85 tonnes on Thursday.

Traders in Asian fixed sold gold reserves after the increase in prices last week to a maximum of more than two years, and jewelers in India continue to offer huge discounts.

The cost of the August gold futures on the COMEX fell to $ 1322.6 per ounce.