- Asian session review: yen little changed

Market news

Asian session review: yen little changed

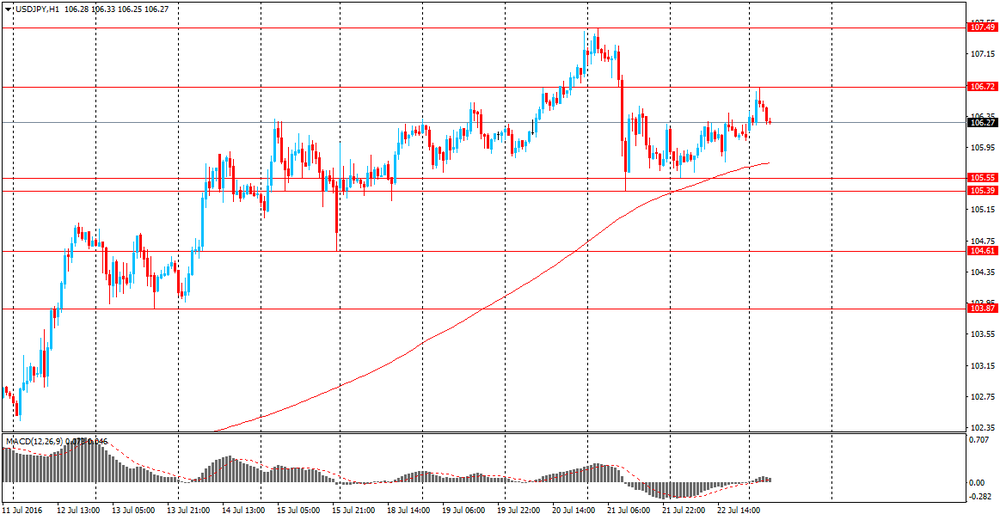

The yen fell in the beginning of the session, but in the course of trading recover lost ground against the backdrop of more positive than expected data on the trade balance of Japan. Total Japan's trade surplus in June amounted to ¥ 692.8 billion, above analysts' expectations of ¥ 494.8 Bln. The previous value was revised from ¥ -41 billion to ¥ -40,6mlrd.

Exports fell -7.4% in June, year on year, after falling 11.3% in May. Analysts had expected a decline to -11.6. Exports to the US fell by 6.5%, exports to Asia fell 10.6% and 10.0% in China.

Imports fell by -18.8% while analysts had expected a drop to -19.7%. The previous value was -13.8%

The adjusted trade surplus amounted to Y 335.0 billion in June, after rising to Y269.8 billion in May.

In June, Japan's exports were lower than expected, but the trade surplus is due to a large fall in imports

Also today, the Government of Japan in its quarterly report, observed a light easing of moderate economic recovery. Has also left an overall assessment of the economy unchanged, but reduced the assessment of business confidence in the government also noted that Brexit increased global economic uncertainty.

The coincident index - the composite indicator that tracks the current state of the Japanese economy in May was 109.9, lower than the previous value of 112.0 and indicates a decline in economic activity in Japan. The index of leading indicators in May amounted to 99.7 after 100 in April.

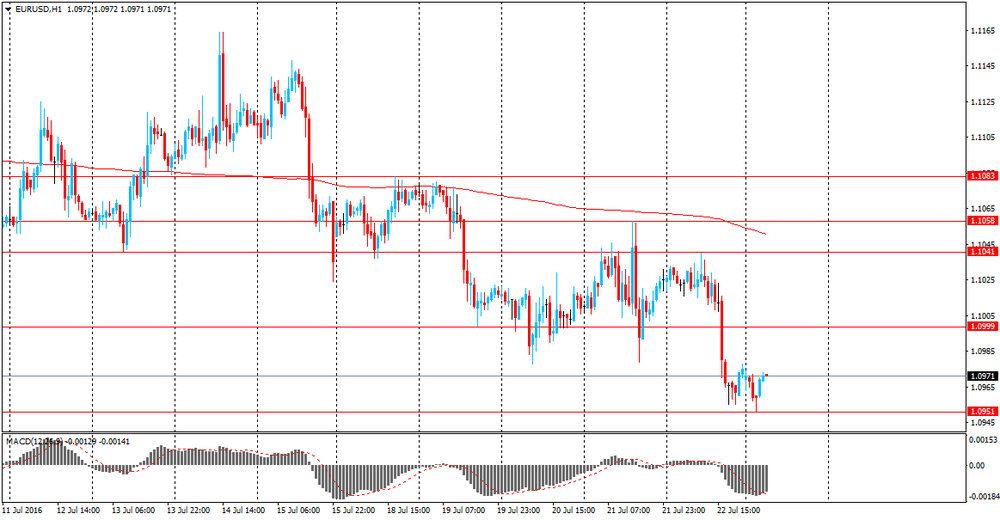

Since the beginning of the trading session, the US dollar continued to rise against the euro, by updating the monthly highs, which was caused by correction of positions before the weekend, and very good data from US business activity. According to analysts recent US data increases the likelihood of the Fed raising interest rates. This is unlikely to happen at the July meeting, but closer to the end of the year. Futures on the federal funds currently estimate a probability of 20% for a rate hike in September. Meanwhile, the chances increase in December to 40% compared with less than 20% a week ago, and 9% at the beginning of the month.

According to Reuters latest survey, just over half of the 100 economists expect the Fed to raise rates in the fourth quarter to 0.75 percent compared with 0.25-0.50 percent currently. The change is likely to occur in December, as the November meeting of the Central Bank will begin in just a few days before the election on 8 November. The rest of the respondents forecast growth in the third quarter, most likely in September.

EUR / USD: during the Asian session, the pair was trading in the $ 1.0950-75 range

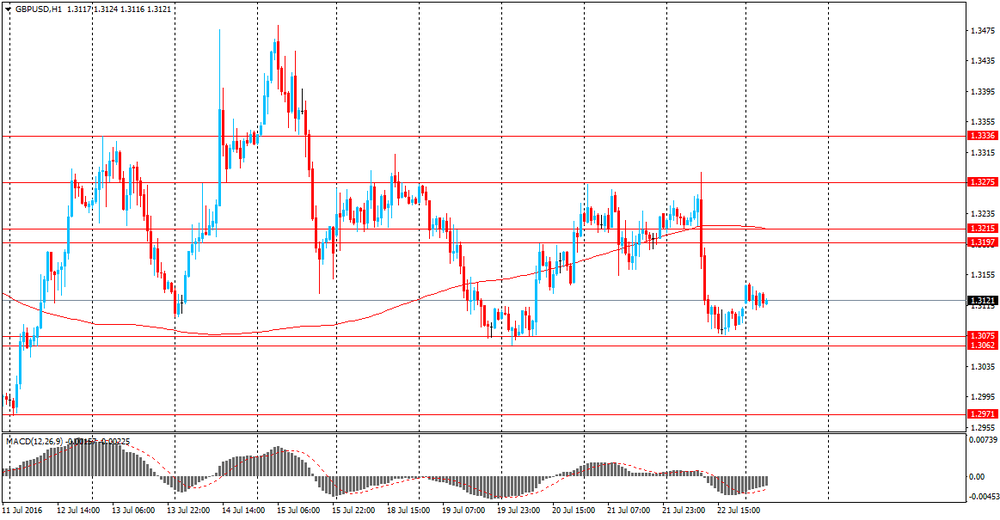

GBP / USD: during the Asian session, the pair was trading in the $ 1.3110-30 range

USD / JPY: during the Asian session, the pair was trading in 106.10-15 range