- Gold rose moderately

Market news

Gold rose moderately

Gold recovered after a decline earlier in the day and after a strong labor market data in the United States that increased the likelihood of a Fed interest rate hike.

The number of people employed in the US economy, excluding the agriculture sector in July rose for the second month in a row, giving the market confidence in the near future.

"The price of gold in the morning is under pressure. This is a continuation of the reaction to Friday's data -.. Said ABN AMRO analyst Georgette Boele -. Expectations for a rate hike rise are increasing after Friday."

According to the futures market, the likelihood of the Fed raising interest rates this year reached 47%, said Commerzbank.

Physical demand for gold in countries such as China and India generally restrained. In the future, analysts expect a quiet trading course this week, while it is likely a further decline of the price.

"If there is no new signs of deterioration in the economic situation, the demand for safe-haven assets weakened," - said Warren Kreytsig of Julius Baer.

Stocks of the world's largest gold exchange-traded fund SPDR Gold rose on Thursday by 0.37 percent to 973.21 tons.

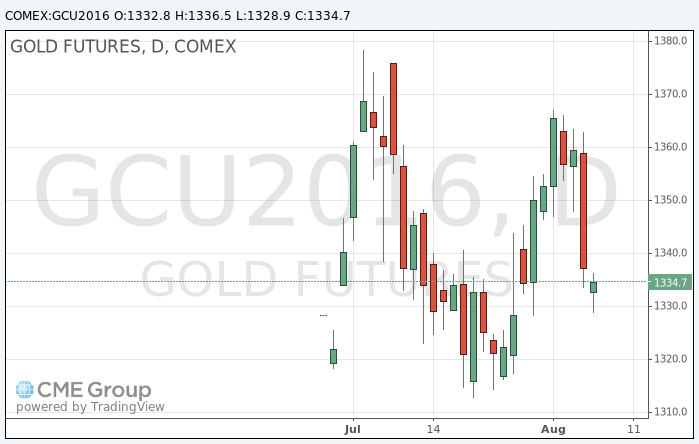

The cost of gold September futures on COMEX rose to $ 1,336.50 an ounce.