- Here’s why Goldman Sachs adds to gold longs above $1367

Market news

Here’s why Goldman Sachs adds to gold longs above $1367

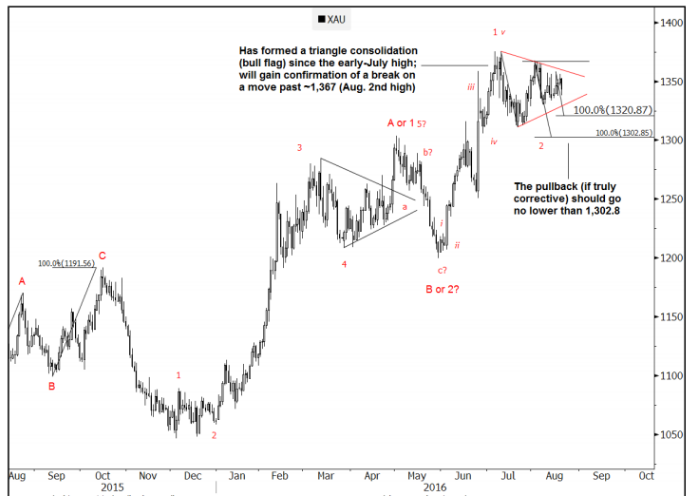

"Gold has formed a triangle like consolidation since the July 11th high. Initial support comes in at 1,321. If this is truly a corrective pattern, it should go no lower than 1,302.85 (ABC from July 11th).

Will gain confirmation of an upside break through the Aug. 2 nd high which is up at 1,367.

Once a complete correction is in place, the level to target is 1,457; an ABC equality taken from the Dec. '15 low. Will re-assess the impulsive or corrective nature of the rally if/once the market does reach this 1,457 pivot. In other words, breaking past 1,457 will suggest that a more meaningful rally could be developing (i.e. wave III of V).

View: Sideways/ overlapping initially. Add to bullish exposure above 1,367, with an initial upside target at 1,457. Should go no lower than 1,302.85 (ABC from July 11th)".

Copyright © 2016 Goldman Sachs, eFXnews™