- Japanese Retail Traders Bought GBP Dips And Back To Long GBP/JPY - Morgan Stanley

Market news

Japanese Retail Traders Bought GBP Dips And Back To Long GBP/JPY - Morgan Stanley

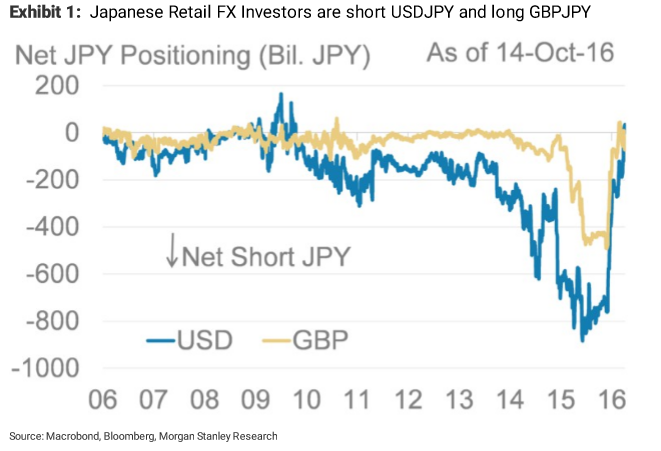

"The weekend after the GBP flash crash, it seems that Japanese retail FX traders bought the dip and are now back to being long GBPJPY. Our tracker also shows they are now short USDJPY for the first time since 2010.

So far, GBPJPY has remained flat since they started buying last week but we think short JPY positioning could increase if the momentum for the pair starts to turn higher. The level of gilt yields relative to JGBs was previously an indicator for Japanese investor flows into gilts, with a bit of a lag. Over recent months however, these investors have been buying gilts no matter what the level of yields.

For now our rates strategists are short gilts but we note that the recent sell-off could eventually support some foreign flows into the gilt market, as even with an FX hedge, gilts have the second highest yield in the G10 after Sweden.

Morgan Stanley keeps targeting current GBP rebound at 1.2650".

Copyright © 2016 Morgan Stanley, eFXnews