- European session review: the US dollar weakened

Market news

European session review: the US dollar weakened

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 Germany consumer confidence index from the GfK November 10 10 9.7

8:30 UK approved applications for mortgage loans on the BBA figures, th. September 36.97 37.3 38.3

"We have seen a fairly sharp rise in the dollar, so there is nothing surprising in a turn", - says Simon Smith, chief economist at FXPro.

According to him, the focus shifted to the prospects for interest rates in 2017, which implies limited potential for the growth of the dollar due to skepticism about the likelihood of further rate hikes. The dollar index fell 0.25%.

Yesterday ECB President Draghi defended the ongoing monetary policy, saying that the extremely low interest rates did not cause harm to consumers in Germany. According to him, the ECB will pursue this policy until inflation reaches the target level. This announcement will strengthen expectations that ECB will extend the asset purchase program.

Published on Wednesday morning, the data on consumer confidence in Germany pointed to decrease to 9.7 index points, while analysts had expected a pullback to 10 points. This was the lowest value of the consumer confidence index in 4 months.

"Despite the slightly more pessimistic outlook for personal finances, consumers believe that the economic outlook has improved, and the corresponding index rose to a maximum of more than one year", - said Mantas Vanagas, an economist at Daiwa Capital Markets Europe.

Meanwhile, the consumer confidence index in France, compiled by the INSEE statistics agency, in October rose to the highest since 2007. The index reached a level of 98 points, but remains below 100 points, long-term average since 1987.

The head of the Bank of England Governor Mark Carney said that there are limits to monetary policy, and that monetary policy was overly burdened in recent years. Carney noted that the bank's obligations are very clear regarding the inflation rate, and that the bank will use all the tools at its disposal to achieve the inflation target. The comments supported the pound.

EUR / USD: during the European session, the pair rose to $ 1.0934

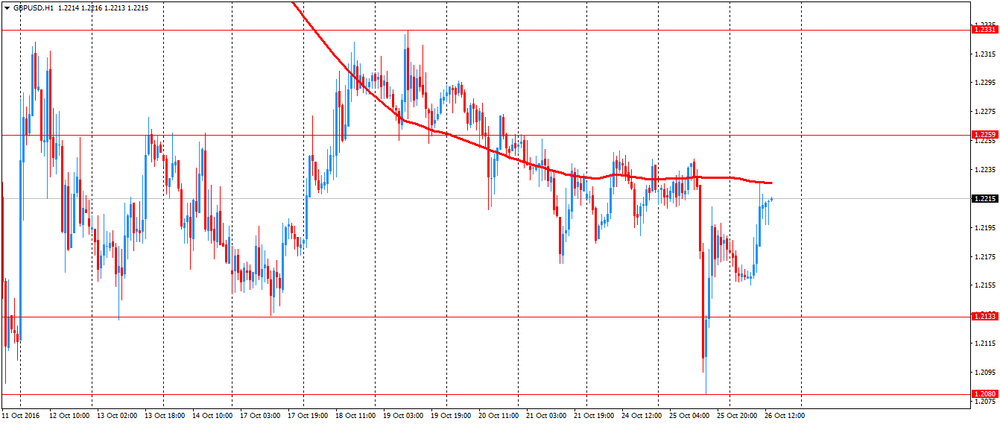

GBP / USD: during the European session, the pair rose to $ 1.2226

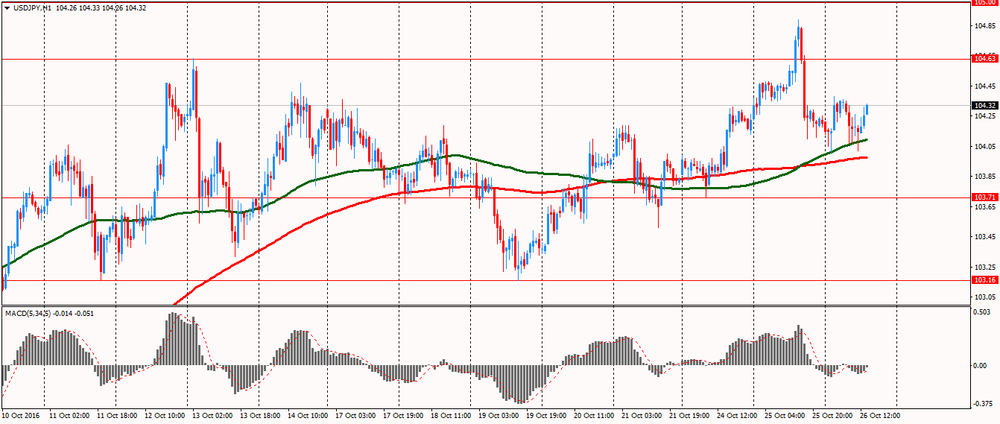

USD / JPY: during the European session, the pair fell to Y104.02