- Asian session review: The dollar fell against the yen

Market news

Asian session review: The dollar fell against the yen

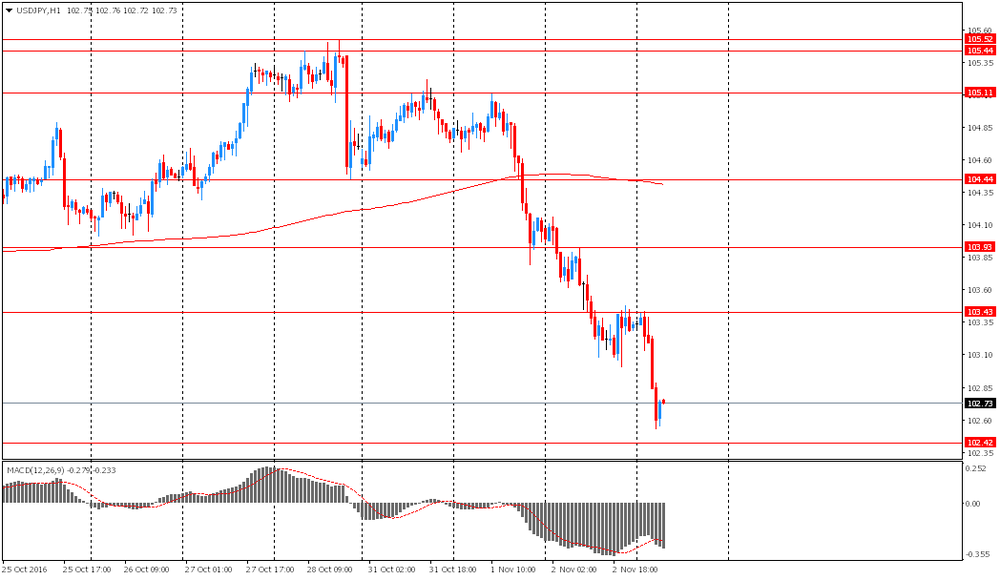

The dollar fell against the yen to a month low after yesterday's decline of 0.8%. Market participants believe the Japanese currency a safe haven, so in times of uncertainty the demand for it is growing. Over the past two weeks, the dollar lost more than 1% against the yen, due to increased uncertainty regarding the results of the US presidential election, to be held next week. The results of the poll this week showed that the popularity of the Republican candidate Donald Trump rose after FBI announced the resumption of the investigation on Clinton's emails. "A week before the election, the markets finally began to take into account the volatility which may occur on the voting results, - wrote Credit Suisse - closing the gap between the candidates.

The Australian dollar rose on positive data from Australia and China. According to the data released today, the index of activity in the service sector by AiG, published by the Australian Industry Group, in October was 50.5 points higher than September's 48.9 value. The index of business activity in China's services sector in October was 52.4, higher than the previous value of 52.0.

Also today, it was reported that the deficit of the foreign trade of Australia in September amounted to $ 1.23 billion, which is less than the deficit recorded in August $ 1,89.

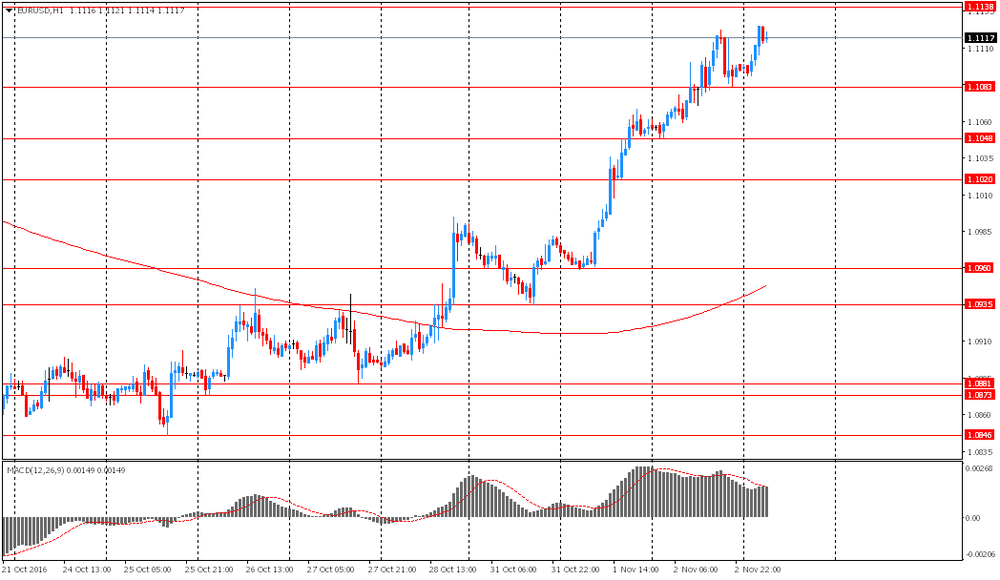

EUR / USD: during the Asian session, the pair rose to $ 1.1125

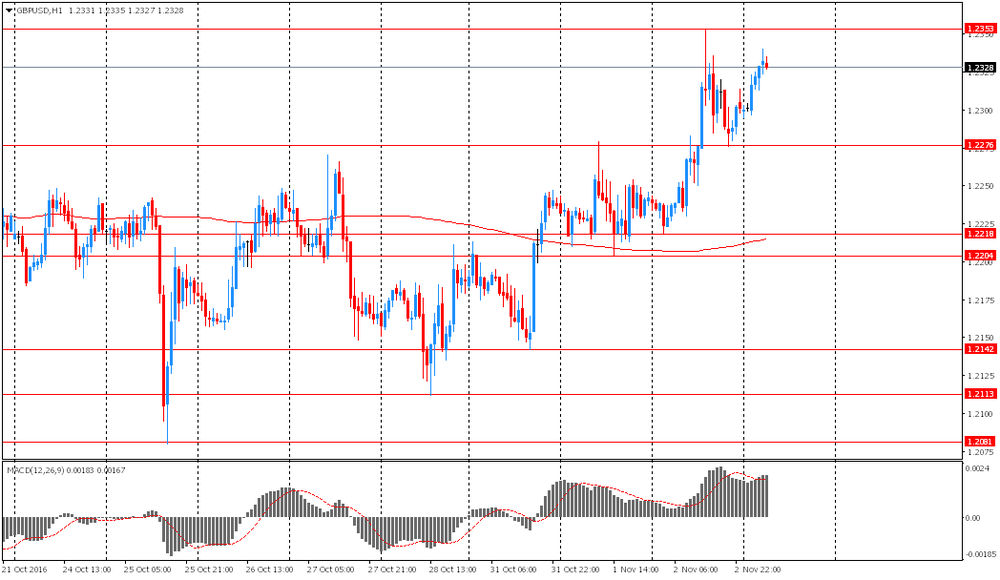

GBP / USD: during the Asian session, the pair rose to $ 1.2335

USD / JPY: fell to Y102.55