- Barclays says GBP is oversold but vulnerable to further flash crashes

Market news

Barclays says GBP is oversold but vulnerable to further flash crashes

"The key question for sterling's evolution from here is whether or not the Brexit uncertainty discount is sufficient.

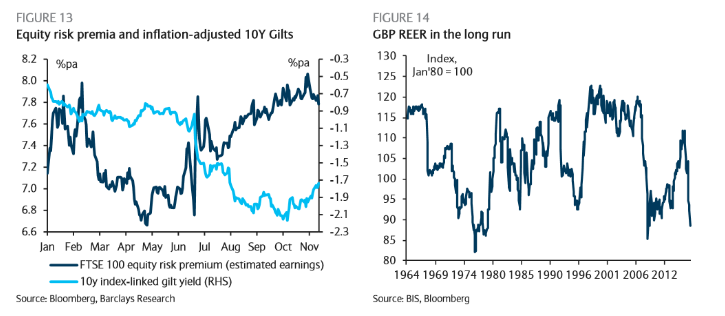

While the ultimate resolution of Brexit may have an impact on GBP's equilibrium value, at current levels, GBP represents clear long-term value, having been cheaper on a real effective basis only twice in the last half century: briefly at the depths of the Global Financial Crisis, and during its mid-70s balance of payments crisis (Figure 14).

In our view, this is more than sufficient discount, but that does not mean that GBP cannot get cheaper still.

While the medium-term value of GBP is extremely compelling, there is a strong incentive for buyers of long-term UK investments to wait for the Government to announce its Brexit negotiation plans. This leaves GBP exposed to further "flash crashes", particularly in periods of illiquidity as important constitutional questions regarding the Government's path to trigger Article 50 remain in question.

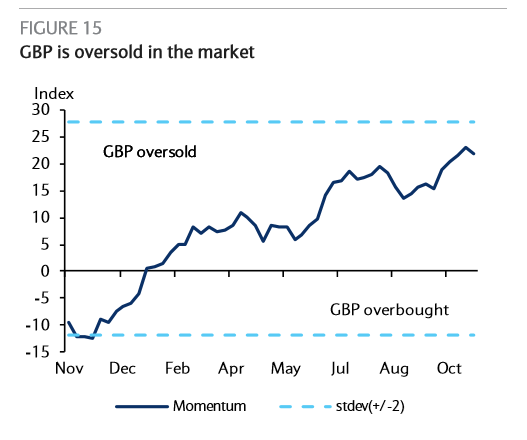

That said, positioning in GBP appears quite short and momentum indicators are indicative of oversold GBP positions (Figure 15),limiting the ability of GBP to extend significantly lower, even over short horizons".

Copyright © 2016 Barclays Capital, eFXnews™