- Credit Agricole thinks this weak's Tankan Survey will provide an important signal for USD/JPY

Market news

Credit Agricole thinks this weak's Tankan Survey will provide an important signal for USD/JPY

"Investment spending and large manufacturers' forecasts for the USD/JPY are likely to be the highlights in this week's Tankan survey. Despite sentiment remaining above average, investment spending has not followed in 2016.

One of the reasons for this has been the stronger JPY. The JPY's recent weakening could improve the outlook for investment in Japan.

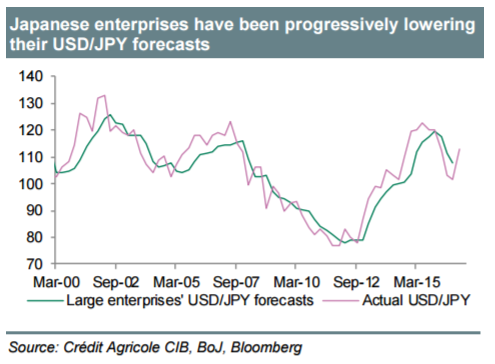

Large enterprises have progressively been lowering their forecasts for average USD/JPY in 2016, but the recent rally may have halted these revisions, which would be indicative of Japanese exporters not feeling pressured to sell USD/JPY on rallies for hedging purposes. It would also be a good sign for investment".

Copyright © 2016 Credit Agricole CIB, eFXnews™