- Barclays is selling the facts at today’s FOMC

Market news

Barclays is selling the facts at today’s FOMC

"Wednesday's FOMC meeting is unlikely to provide a catalyst for further USD strength and may instead encourage profit taking on long USD positions as we approach year-end, particularly in currency pairs where the USD is most expensive.

A 25bp hike is widely expected by both interest rate markets (23bp of hikes priced) and analysts, including ourselves. Furthermore, fed funds futures imply a policy path for the coming year that is broadly consistent with the median FOMC participant September forecast (implied year-end 2017 fed funds rate of 0.96% versus median FOMC forecast of 1.1%). In its forward guidance, we expect Chair Yellen to balance the decision to raise rates with a dovish message of a shallow expected policy path and a willingness to test the potential benefits of running a "high pressure" economy.

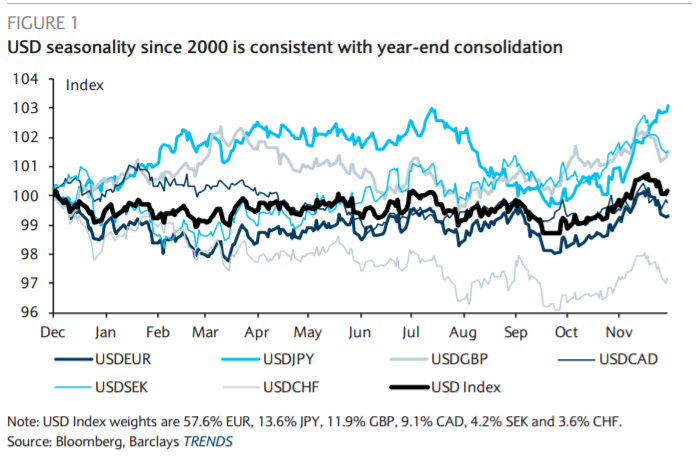

Positioning, valuation and seasonal factors also support some near-term USD consolidation. Our FX flow data are consistent with indications from FX futures markets, which suggest that speculative investors remain significantly long the USD. With USD appreciation of about 4% since early October on a trade-weighted basis, to a point where we estimate the USD is close to 20% expensive, we think there is strong incentive for these investors to unwind some of their positions as year-end approaches.

Seasonal considerations also suggest the USD, on an index basis, tends to weaken into year-end".

Copyright © 2016 Barclays Capital, eFXnews™