- Barclays has 3 reasons for sharper near-term USD upside risks

Market news

Barclays has 3 reasons for sharper near-term USD upside risks

"Last week's FOMC meeting was more eventful than what we and the market were expecting. We read subtle hawkish signals regarding the outlook of monetary policy, therefore tilting risks for the USD toward a sharper appreciation in the months to come (see USD upside risks), against our expectations of USD consolidation

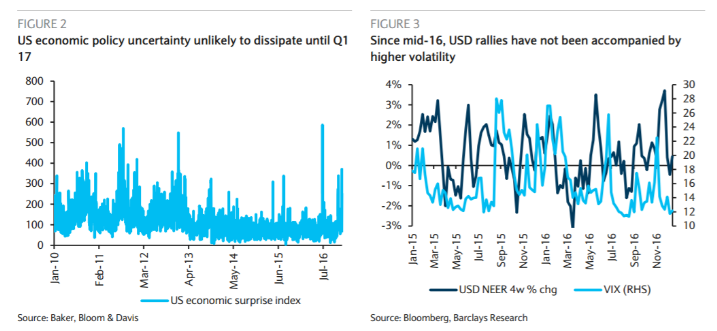

First, because any potential fiscal boost from the Trump administration is still very uncertain (Figure 2), it has yet to be incorporated into the FOMC's economic outlook, as only "some" members included it in their projections. Therefore, we see further room for the market to price in a steeper path for the fed funds rate in 2017, as fed funds futures are pricing only 55bp of hikes in the year to come.

Second, the FOMC seems less concerned about the effect of a higher USD and rates. Unlike previous episodes, the USD recent uptrend has not been accompanied by higher volatility or a sharp move lower in commodity prices (Figure 3), something that had constrained the Fed before from accelerating its normalization pace. It looks like Chair Yellen now sees the re-pricing in US assets as consistent with the improvement in the job, growth and inflation outlook stemming from the market's implicitly pricing a more expansionary fiscal policy.

Third, the appetite for running a "high pressure" economy to boost productivity growth at this point of the business cycle is diminishing. Although Chair Yellen emphasized the fact that the revision in the median projection of the 2017 dots, employment and growth outlook was very moderate, she did not stress as much as in the past the fact that the normalization process should be gradual".

Copyright © 2016 Barclays Capital, eFXnews™