- Round trip for USD/JPY; Seasonal factors in play for USD/CAD - Barclays

Market news

Round trip for USD/JPY; Seasonal factors in play for USD/CAD - Barclays

"USDJPY is poised to finish 2016 as the year of the great round trip, with the pair declining from 120 to 99 just after the Brexit vote and almost fully reversing this move after the US election and the hawkish Fed hike. The BoJ's yield curve control has helped this sharp rally by squeezing volatility out of JGB markets into FX markets, increasing its sensitivity to US yields.

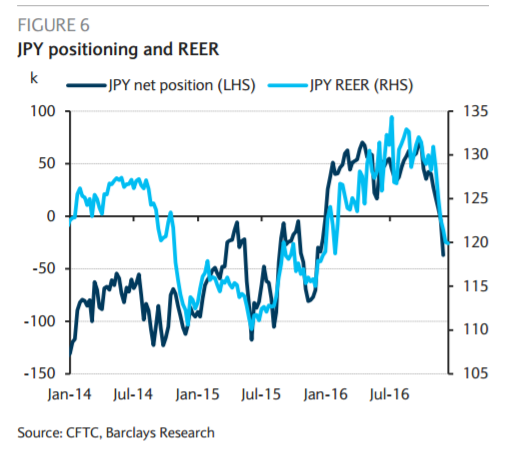

Solid US data and expectations for Trump policies are likely to keep USDJPY supported at least into early next year, with upside risk when US policy outlook should become clearer, although we remain wary of some downside risk from unexpected risk-off events, given the resurging undervaluation of the JPY and speculative positioning now turning net short JPY.

....Historically, the loonie trades weakly in December, as typical seasonal factors favor the USD and hurt oil prices. After the OPEC agreement, we expect limited upside for oil prices in the next couple of weeks, and the more hawkish tone of the FOMC poses upside risks for the USD globally.

However, significantly short CAD positioning and short-term undervaluation limits CAD downside, in our view, and the loonie is likely to remain range-bound in the next few weeks, amid light year-end flows".

Copyright © 2016 Barclays Capital, eFXnews™