- We stay short EUR/USD - Credit Agricole

Market news

We stay short EUR/USD - Credit Agricole

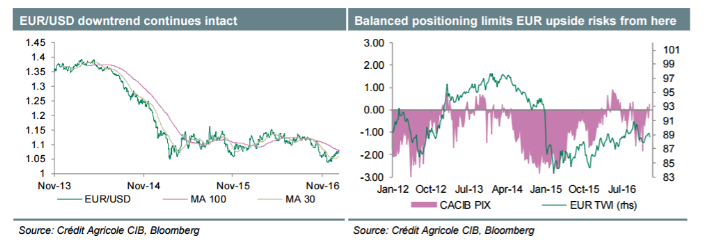

"This week will be quiet in terms of top tier data releases. As such we expect majors such as EUR/USD to be driven still by external factors like global risk sentiment and Fed rate expectations.

With investors' Fed monetary policy expectations unlikely to rise in the short-term and as global risk sentiment appears more unstable given rising uncertainty when it comes to protectionist developments, as driven by US President Trump, it cannot be excluded that the pair face further upside risks. However, intact uncertainty related to French elections and the scope of an early election in Italy, should keep the upside fairly limited from the current levels.

We believe that any further upside from current levels is corrective rather than a change in trend and fairly balanced speculative positioning, as confirmed by our FX positioning gauge, supports such a view.

As such we are of the view that rallies should be sold and we remain short EUR/USD.*

Credit Agricole maintains a short EUR/USD from 1.0705 targeting 1.0300".

Copyright © 2017 Credit Agricole CIB, eFXnews™