- USD/CAD still moves in 'Mysterious' way, according to Credit Agricole

Market news

USD/CAD still moves in 'Mysterious' way, according to Credit Agricole

"There does not appear to be much of a driver behind the move higher in USD/CAD beyond a generally more negative risk backdrop and a 1.4% decline in oil prices on Monday.

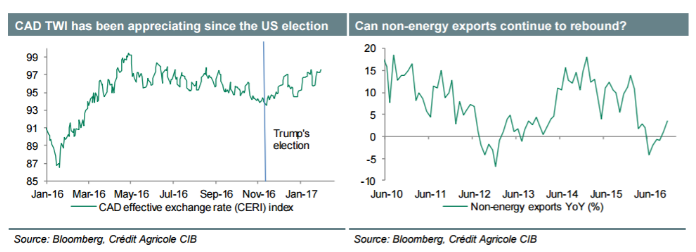

CAD's cross asset correlations have been very weak lately: 30-day rolling correlation between CAD and oil is close to zero, while USD/CAD continues to trade below the levels suggested by US-Canada 2Y rate differentials.Positioning is also close to neutral according to both IMM CFTC data and our in-house positioning indicator, which suggests low levels of investor participation.

This week is busy for Canadian data starting with Wednesday's international trade, building permits and Ivey PMI, while January employment report will also be release on Friday. CAD is the best performing G10 currency (along with SEK) since President Trump's election, which we find puzzling.

In our view USD/CAD should rise to 1.40 by Q3 as US-Canada rate differentials continue to widen (we expect the BoC to remain on hold this year). Furthermore, CAD is now pricing in little risk of US protectionism, which appears overly optimistic".

Copyright © 2017 Credit Agricole CIB, eFXnews™