- TD staying cautious USD near-term. Chatter from the Trump administration will remain the key driver

Market news

TD staying cautious USD near-term. Chatter from the Trump administration will remain the key driver

"With major currencies approaching key technical levels, the markets are closely following the movements in the broad USD index.

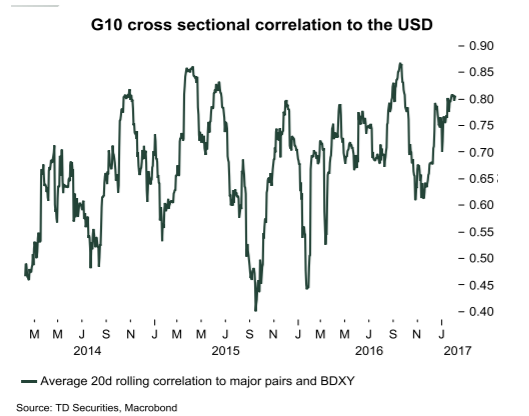

The first chart shows the 20d rolling correlation of the BDXY to the major G10 currencies. It shows that the moves in the BDXY and the broader G10 are closely synchronized. This correlation has averaged around 65% over the past few years so the lift in the correlation indicates the importance of the broader USD move at the moment.

We think chatter from the Trump administration regarding its key policy objectives over the first 100 days will remain the key driver. The second week in office showed little appetite to discuss broader tax reform. Indeed, policy makers spent more time discussing 'bad' trade deals and the value of international exchange rates than fiscal stimulus or tax reform. The scope for a BAT is still unknown with the Senate mulling the idea of proposing its own tax reform bill. Recall, the House's budget plan relies on the tax to fund the personal and corporate tax cuts so it is key to broader reform.

These complications and lack of consensus over them keep us cautious on the USD in the near-term".

Copyright © 2017 TD Securities, eFXnews™