- WSE: Session Results

Market news

WSE: Session Results

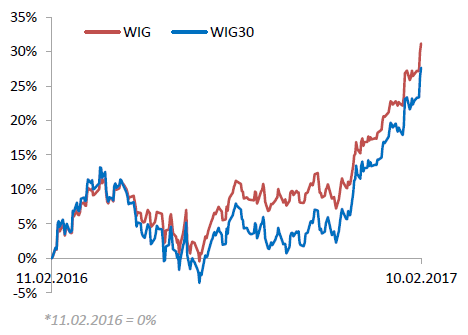

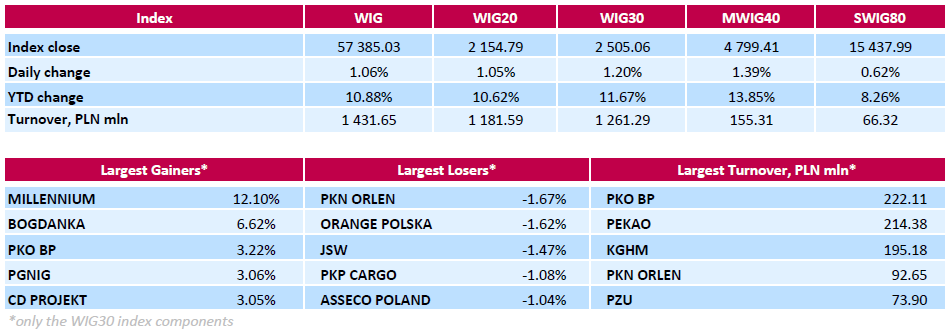

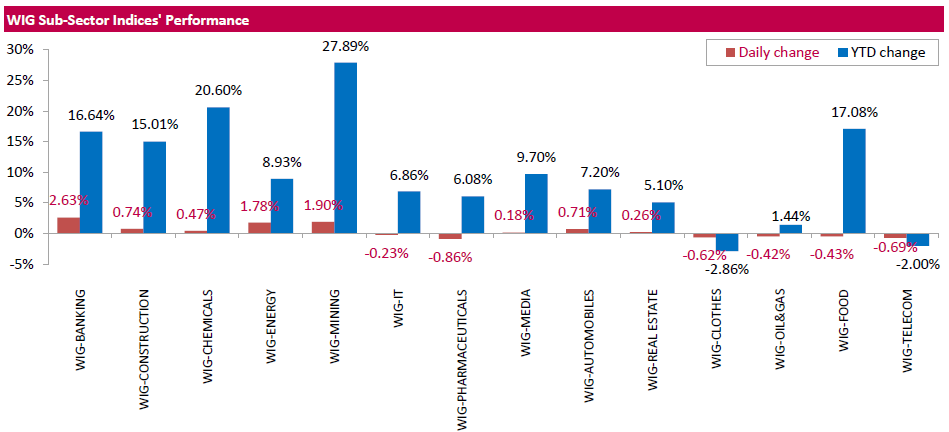

Polish equity market closed higher on Friday with the broad market measure, the WIG Index, surging by 1.06%. Sector performance within the WIG Index was mixed. Banking sector stocks (+2.63%) outperformed, helped by comments by ruling party leader Jaroslaw Kaczynski that the Polish borrowers seeking compensation for being sold expensive Swiss franc-denominated mortgages should go to courts to demand compensation from banks because the government has to protect the stability of the financial system. At the same time, pharmaceuticals names (-0.86%) recorded the biggest drop.

Large-cap stocks' measure WIG30 rose by 1.2%. Nearly 2/3 of the 30 companies in the index basket advanced, and bank MILLENNIUM (WSE: MIL) fared particularly well, climbing by 12.1%. Apart from Kaczynski's comments on FX loans, the stock was also supported by the bank's CEO Joao Bras Jorge statement that MILLENNIUM was not expected to be faced with the need for additional external capital to comply with the new recommendations of the financial stability committee KSF. All potential increases in risk weights for loan exposures would be covered by the bank's retaining earnings, the CEO said, adding that the full 2016 profit would stay at the bank. Other major gainers were thermal coal miner BOGDANKA (WSE: LWB), bank PKO BP (WSE: PKO), oil and gas producer PGNIG (WSE: PGN) and videogame developer CD PROJEKT (WSE: CDR), jumping by 3.05%-6.62%. On the contrary, oil refiner PKN ORLEN (WSE: PKN), became the session's largest decliner with a 1.67% drop, followed by telecommunication services provider ORANGE POLSKA (WSE: OPL) and coking coal producer JSW (WSE: JSW), tumbling by 1.62% and 1.47% respectively.