- SNB to increase intervention again - BNPP

Market news

SNB to increase intervention again - BNPP

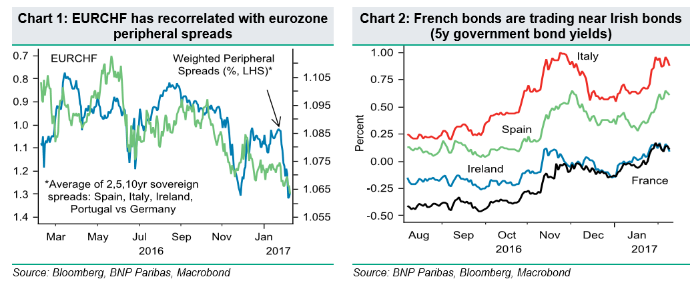

"EURCHF fell to a post-Brexit low below 1.07 at the end of January, likely on the back of reports of a large CHF M&A deal. However, the CHF has continued to rise in February, and we think the most important driver could be the spike in eurozone peripheral spreads. Eurozone peripheral spreads and EURCHF have started to reconverge (Chart 1) and, in our view, the widening of peripheral spreads is leading to safe-haven CHF demand.

However, CHF strength is likely to pressure the Swiss National Bank (SNB) to increase its FX intervention. According to our calculations, the SNB intervened in FX markets in November by approximately CHF 14bn (a record intervention) and CHF 4.9bn in January (in line with recent interventions). This month, the SNB allowed EURCHF to breach 1.07 for the first time, but we think the central bank could start increasing its interventions again, which could counter the safe-haven demand.

This outlook is consistent with our EURCHF target at 1.10 in Q2 17 and 1.12 by the end of the year, although we would not rule out a fall in the pair in the very short term".

Copyright © 2017 BNP Paribas™, eFXnews™