- EUR positions getting vulnerable to squeeze - Scotiabank

Market news

EUR positions getting vulnerable to squeeze - Scotiabank

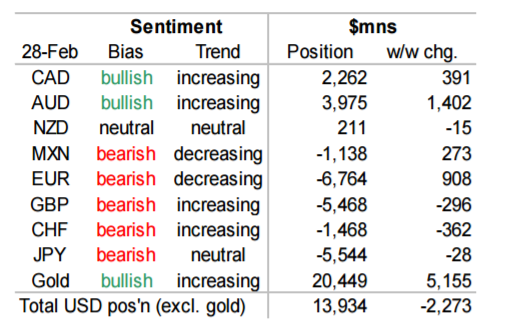

"This week's changes in sentiment were relatively limited, with a build in bullish net long positions in AUD and CAD alongside a narrowing in the net short EUR position. JPY, GBP and CHF were largely unchanged.

The cumulative impact delivered a continued erosion in the aggregate USD long with a $2.3bn w/w decline to $13.9bn-its lowest level since early October 2016.

CAD sentiment improved for a 7th consecutive week, pushing the value of the net long position up $0.4bn w/w to $2.3bn. In contract terms, the 30K net CAD long represents the highest level since February 2013. Note that much of the recent improvement has been driven by a build in bullish gross longs leaving those newly established positions vulnerable to the recent decline in spot.

AUD bulls have also been responsible for the bulk of the recent improvement in sentiment, with gross shorts relatively steady since early October.

EUR saw the second largest w/w swing after AUD with a $0.9bn narrowing in the net short to $6.8bn. Investors have added sizeable risk to both the long and short side over the past two weeks, suggesting uncertainty and leaving those with newly EUR established positions vulnerable to a squeeze.

GBP risk has also been added to both sides".

Copyright © 2017 Scotiabank, eFXnews™