- Bank of America Merrill expects a dovish message from ECB. How to trade?

Market news

Bank of America Merrill expects a dovish message from ECB. How to trade?

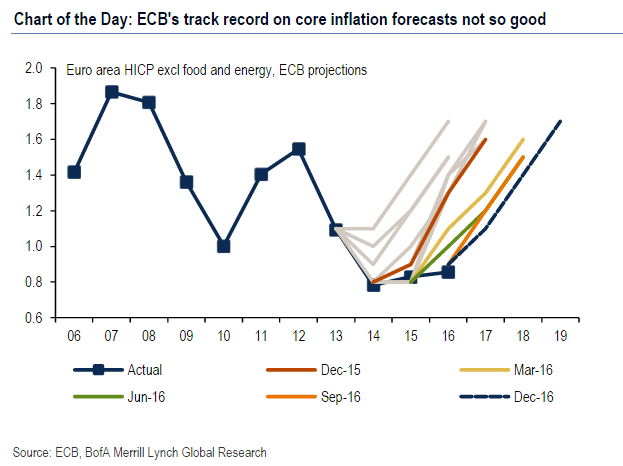

"We think the current "truce" between the hawks and doves will be reflected in a dovish tone by Draghi this week, with no decision. After the summer, though, we think a proper debate about the future of QE will be unavoidable. We expect the ECB meeting to be a non-event for the Euro. Draghi bought time when he extended QE by a year last December and he intends to use it. Eurozone data have continued to improve and headline inflation has reached 2%. However, core inflation remains below 1%, while headline inflation will decline later in the year, as the effect from higher oil prices fades. Draghi knows that he will face challenges later in the year, when markets will be looking for answers about the future of QE, but this is too far from now. Accordingly, we think the March ECB meeting should be a non-event.

The USD and European politics are the main EUR drivers for now. The Fed is the main USD driver, but we expect fiscal policy to become more important in early summer. The French elections have been weighing on the euro and we expect this to continue. Even if Le Pen has a very slim chance based on all polls, markets could get more concerned closer to the elections as her victory could eventually break up the Eurozone.

Assuming no surprises in the European elections, the Euro should gradually strengthen, particularly against JPY, as the market starts pricing the end of ECB QE".

Copyright © 2017 BofAML, eFXnews™