- US Dollar Index edges higher to 93.70 ahead of data

Market news

US Dollar Index edges higher to 93.70 ahead of data

- DXY regains some composure and retests 93.70.

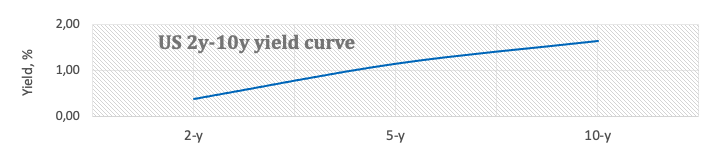

- US 10-year yields faltered above 1.67% once again.

- Weekly Claims, Philly Fed Index next of note in the docket.

The greenback, in terms of the US Dollar Index (DXY), looks to finally regain some buying interest and leave behind the ongoing multi-session negative streak.

US Dollar Index focuses on yields and data

The index posts modest gains early in the European morning following six consecutive daily pullbacks. The moderate leg lower has so far met quite decent contention around the 93.50 zone.

Price action around the dollar has been under pressure on the back of the firm improvement in the risk complex in past sessions, while the lack of sustainability in the recent move higher in US yields also added to the downside in the buck.

Later in the US calendar, Initial Claims and the Philly Fed Index will take centre stage seconded by the CB Leading Index, Existing Home Sales and the speech by FOMC’s Governor C.Waller (permanent voter, centrist).

What to look for around USD

The leg lower in the index has so far met support around 93.50 so far this week. The corrective move in the dollar came in response to the repricing of several central banks particularly in light of elevated inflation and the firm improvement in the risk complex. Supportive Fedspeak, an anticipated start of the tapering process, higher yields and the rising probability that high inflation could linger for longer remain as the exclusive factors behind the constructive outlook for the buck in the near-to-medium term.

Key events in the US this week: Claims, Philly Fed Index, CB Leading Index, Existing Home Sales (Thursday) – Flash Manufacturing PMI (Friday).

Eminent issues on the back boiler: Persistent uncertainty around Biden’s multi-billion Build Back Better plan. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. Debt ceiling debate. Geopolitical risks stemming from Afghanistan.

US Dollar Index relevant levels

Now, the index is gaining 0.05% at 93.64 and a break above 94.17 (weekly high Oct.18) would open the door to 94.56 (2021 high Oct.12) and then 94.74 (monthly high Sep.25 2020). On the flip side, the next down barrier emerges at 93.49 (monthly low October 21) followed by 93.24 (55-day SMA) and finally 92.98 (weekly low Sep.23).