- USD/INR Price News: Indian rupee at the mercy of US rates and the greenback

Market news

USD/INR Price News: Indian rupee at the mercy of US rates and the greenback

- USD/INR bulls meeting support on daily basis.

- Above 0.7440, the bias is bullish. All eyes on the US dollar for the week ahead.

As illustrated below, USD/INR is contained in a flag pattern as it moves towards the support area as marked an eclipse. On the other hand, should US yields and the greenback pick up steam, then the correction will likely be over and there will be probabilities of an upside extension.

USD/INR daily chart

-637707234615053772.png)

On the downside, however, the price would need to break below 0.7440.

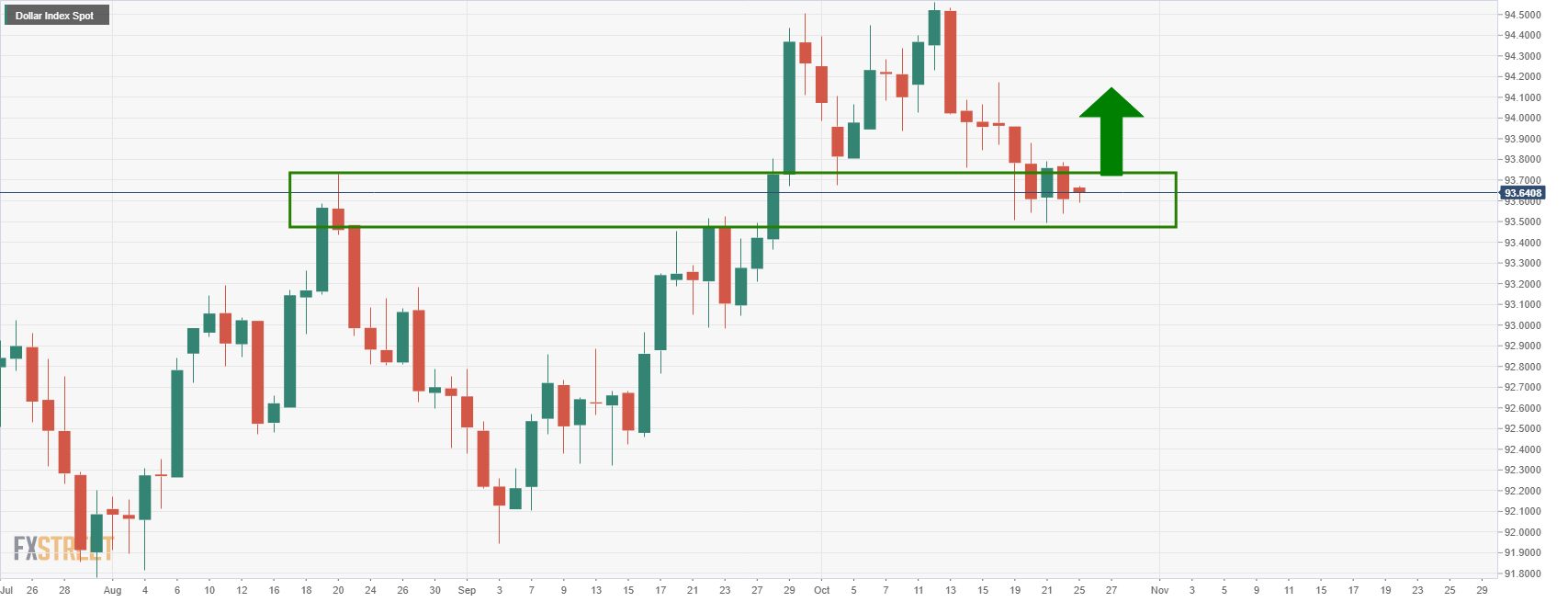

DXY daily chart

The US dollar is meeting a critical support structure which would be expected to hold and potentially lead to a break back towards 94.50. This would be more probable should the US yields continue to climb in the current bullish form of late as follows:

The US 10-year yield has been climbing in a classic impulse, correction, impulse shape and the current dynamic trendline support are about to come under pressure, which could lead to the next bullish impulse.