- Silver is under pressure to a critical daily dynamic support

Market news

Silver is under pressure to a critical daily dynamic support

- Silver is under pressure as investors move into the greenback.

- Event risks are looming with critical central banks meetings slated this and next week.

- US yields are adding pressures with the 10-year yield now at critical dynamic support.

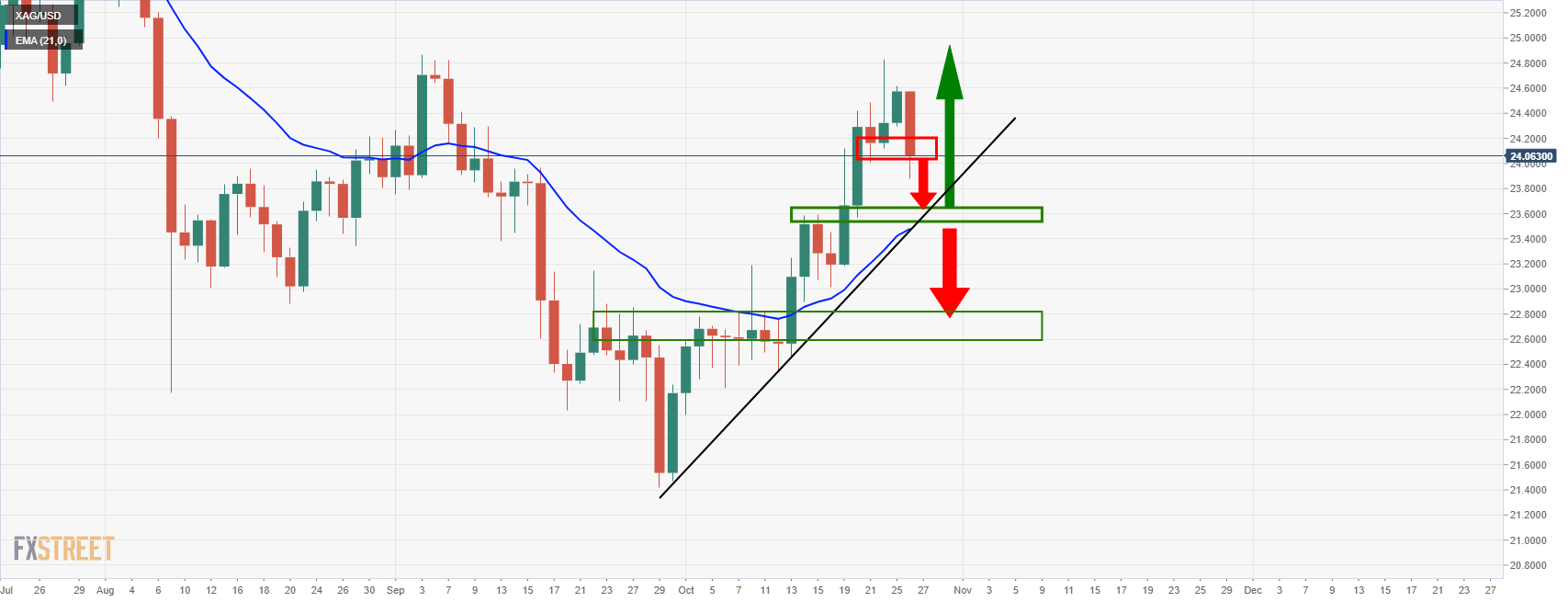

The price of silver is down heavily on the day following an aggressive 4-hour candle that extended the drift from Asian flows back into the US dollar. At the time of writing, XAG/USD is trading near $24.0430, down 2.13% after falling from a high of $24.58 to a low near $23.87.

The greenback has been stuck in a narrow range while markets await news from central bankers this and next week which include the European Central Bank on Thursday, the Bank of Canada tomorrow (Wed), and the Federal Reserve next week. The US dollar, as measured by the DXY index, was unchanged bid at 93/95 at the time of writing which is hurting precious metals today. There has been a strong rally in the greenback which has based at a triple bottom low on the 4-hour charts following a breakout from a downtrend that started on Oct 12.

US yields in focus

Investors could well be positing ahead of the slew of central bank meetings and economic critical data that could shift views on interest rates, inflation and growth rates. In this regard, the yields on 10-year U.S. note is testing critical trendline support which could equate to a fresh run to the upside, supportive of the US dollar and a headwind for precious metals:

At the time of writing, this is yielding 1.6263% in the mid-day of the New York session. Meanwhile, analysts at TD Securities argue that the hunt for inflation protection is intensifying.

''Ten-year breakeven yields continue to firm at their highest levels since 2012, as speculators brace for inflation. In this context, global markets remain intensely focused on pricing the Fed's exit, with the recent surge in market-based inflation expectations fueling bets for an earlier Fed hike.''

''Yet, we continue to argue that market pricing for Fed hikes remains far too hawkish as it fails to consider that a rise in inflation tied to a potential energy shock and lingering supply chain shortages would be unlikely to elicit a Fed response,'' the analysts argued.

''In fact,'' they said, ''the market is increasingly pricing in a policy mistake which is unlikely to take place, considering that central banks are likely to look past these disruptions as their reaction functions have been historically more correlated to growth than inflation.''

Silver & DXY technical analysis

The confluence of the daily dynamic and 21-day EMA is compelling. A break to there could see the price rally. Or, alternatively, there are likely risks below the support to the next layer down near the head and shoulders neckline.

Meanwhile, the US dollar is looking as though it is make or break time:

The rally has made a 38.2% Fibo retracement and that could be expected to resist leading to a downside test of the dynamic trendline support. If, on the other hand, it breaks the resistance, then the next layer is located in the highs near 94.50 which would likely cripple the precious metals for the near term.