- Gold Futures: Further decline appears limited

Market news

27 October 2021

Gold Futures: Further decline appears limited

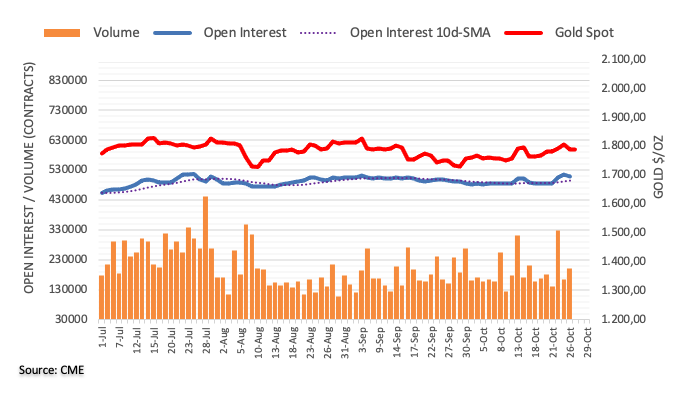

CME Group’s flash data for gold futures markets noted open interest reversed two consecutive daily builds and shrank by around 5.8K contracts on Tuesday. Volume, instead, extended the erratic activity and went up by around 39.5K contracts.

Gold faces the next hurdle at $1,813

Tuesday’s negative price action in gold was accompanied by shrinking open interest and is indicative that a deeper retracement in prices of the yellow metal appears not favoured in the very near term. In the meantime, the monthly peak at $1,813 per ounce troy continues to cap intermittent bullish attempts for the time being.

Market Focus

Open Demo Account & Personal Page