- Crude Oil Futures: Near-term top in place?

Market news

Crude Oil Futures: Near-term top in place?

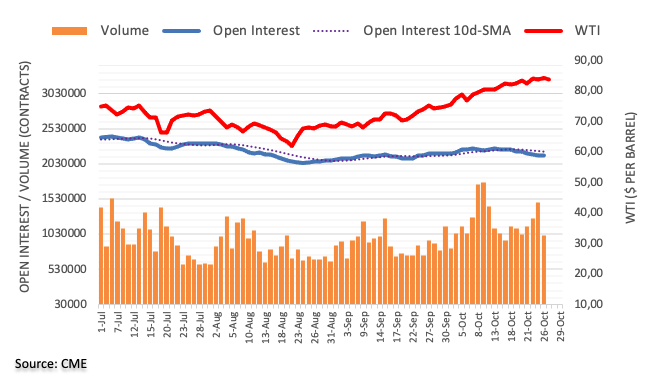

Preliminary readings from CME Group noted traders scaled back their open interest positions in crude oil futures markets for yet another session on Tuesday, this time by around 8.2K contracts. In the same line, volume reversed three daily pullbacks in a row and went down by around 468.3K contracts, the largest single-day drop since July 2.

WTI faces some consolidation/correction

Tuesday’s decent advance in WTI prices was amidst shrinking open interest and volume, leaving the probability of extra gains somewhat curtailed in the very near term. That, plus the current overbought conditions could encourage some corrective move sooner rather than later, while the upside stays capped by the YTD highs past the $85.00 mark per barrel.