- GBP/USD Price Analysis: Sellers attack 50-DMA on monthly support break

Market news

GBP/USD Price Analysis: Sellers attack 50-DMA on monthly support break

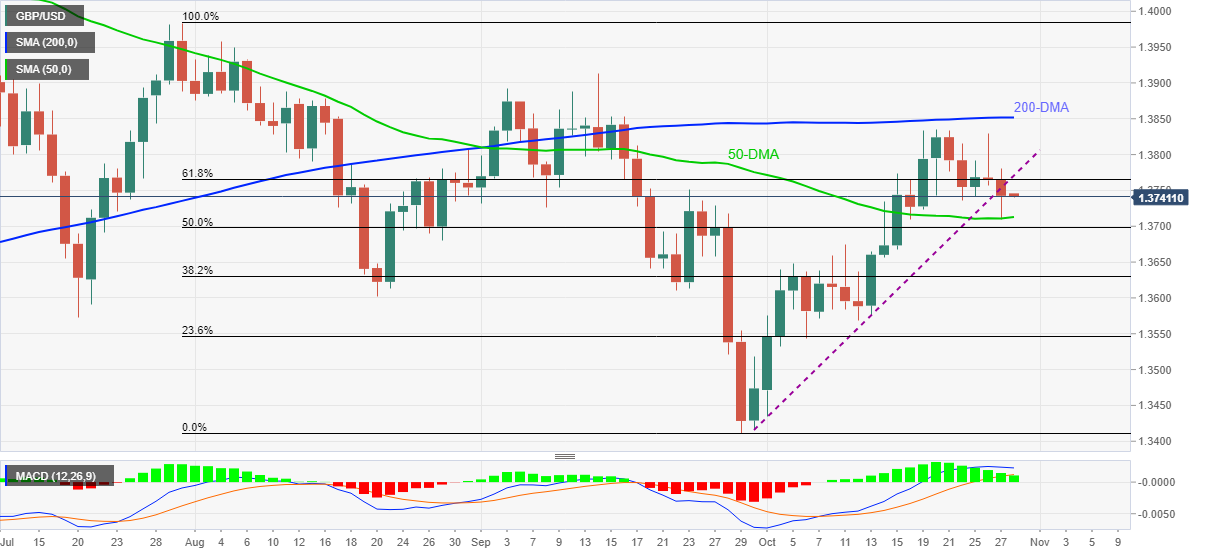

- GBP/USD fades bounce off weekly low, keeps monthly support line breakdown.

- Bullish MACD challenges downside past 50-DMA, recovery moves have a bumpy road below 200-DMA.

GBP/USD prints a three-day downtrend following the key support break, pressured around 1.3740 during the early Asian session on Thursday.

The cable pair broke an ascending support line, now resistance, from September 30 the previous day but refrained from closing below 50-DMA.

Given the bullish MACD signals and multiple supports around the 1.3710-3700 area, comprising 50-DMA and 50% Fibonacci retracement of late July-September fall, the GBP/USD pair’s heavy downside remain doubtful.

However, a daily closing below 1.3700 won’t hesitate to direct the pair bears towards August lows of 1.3600.

Meanwhile, a convergence of the previous support and 61.8% Fibonacci retracement level near 1.3770-75 guards the quote’s corrective pullback ahead of the 200-DMA level surrounding 1.3855.

In a case where GBP/USD bulls manage to conquer the 1.3855 hurdle, September’s high of 1.3913 and July peak close to 1.3985 may probe the run-up towards the 1.4000 psychological magnet.

GBP/USD: Daily chart

Trend: Further weakness expected