- EUR/USD comes under pressure post-NFP, revisits 1.0170

Market news

EUR/USD comes under pressure post-NFP, revisits 1.0170

- EUR/USD sparks a deeper correction following July’s NFP.

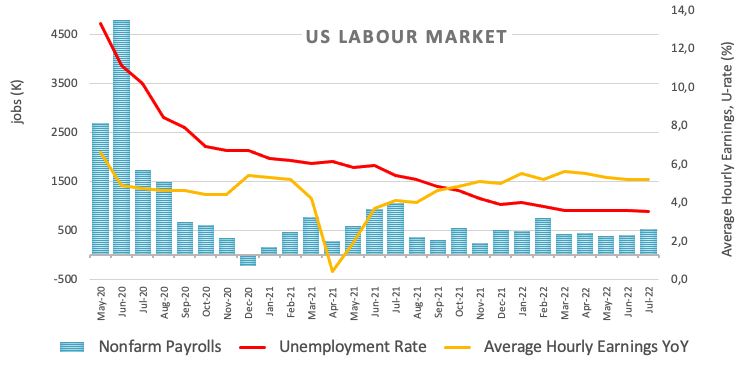

- US Non-farm Payrolls rose by 528K jobs in July.

- The unemployment rate ticked lower to 3.5%.

EUR/USD saw its downside accelerated to the 1.0170 region in the wake of the publication of the US jobs report for the month of July.

EUR/USD weaker on solid US jobs report

EUR/USD remains on the defensive on Friday after US Nonfarm Payrolls showed the US economy added 528K jobs during July, more than doubling the consensus for a gain of 250K jobs. The June’s reading was revised up to 398K (from 384K).

Further data saw the Unemployment Rate improve to 3.5% and the key Average Hourly Earnings – a proxy for inflation via wages – rise 0.5% MoM and 5.2% vs. the same month of 2021. Additionally, the Participation Rate, eased a tad to 62.1%.

EUR/USD levels to watch

So far, spot is retreating 0.71% at 1.0173 and faces the next contention at 1.0096 (weekly low July 26) followed by 1.0000 (psychological level) and finally 0.9952 (2022 low July 14). On the other hand, the breakout of 1.0293 (monthly high August 2) would target 1.0404 (55-day SMA) en route to 1.0615 (weekly high June 27).