- USD/JPY Price Analysis: A significant correction could be in the makings

Market news

USD/JPY Price Analysis: A significant correction could be in the makings

- USD/JPY bulls testing the bear's commitments near the daily resistance area.

- The bears will be looking for a significant retracement in the sessions ahead.

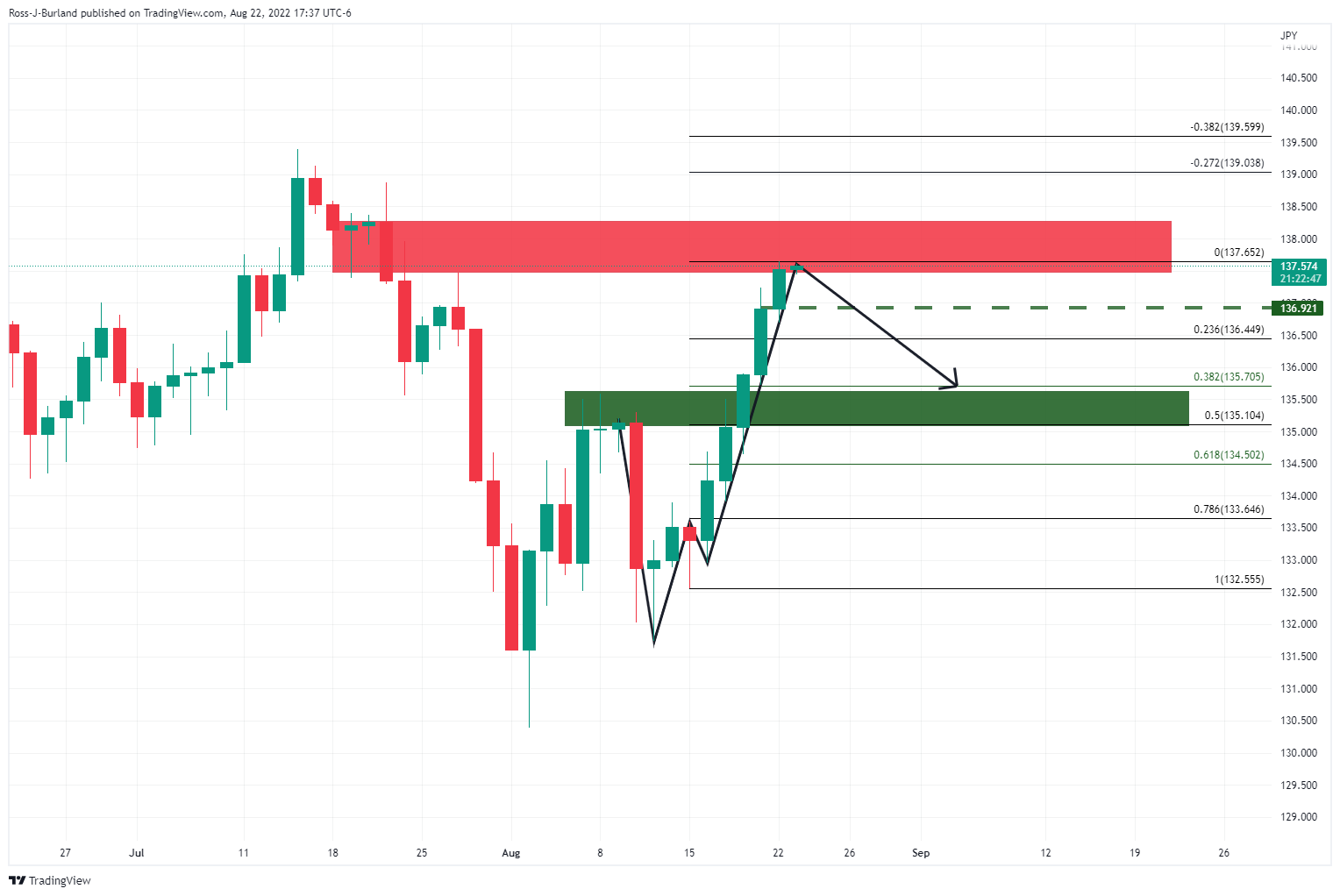

USD/JPY has been relentless on the bid, reaching a daily resistance structure following six consecutive days of higher highs and lows. However, there are higher prospects of a correction the further the rally goes without giving back some ground. The following illustrates this from a daily and hourly perspective.

USD/JPY daily chart

At current levels, the price is reaching into a prior structure that could act as a resistance area and lead to a Fibonacci correction along the scale as illustrated.

USD/JPY H1 chart

For the contrarians, the price could be on the verge of making a peak formation from which the bears will be then seeking a significant correction as a consequence. The price is testing through 137.50 and this could extend into test the 137.80s. However, should the bulls capitulate, then there will be prospects of a move below current support for a run below with 137.13 eyed as an important structure guarding a fall below the 137 round number for a look in below 136.80 in a pump and dump scenario.