- Platinum Price Analysis: XPT/USD stays on the way to $830-29 support zone

Market news

Platinum Price Analysis: XPT/USD stays on the way to $830-29 support zone

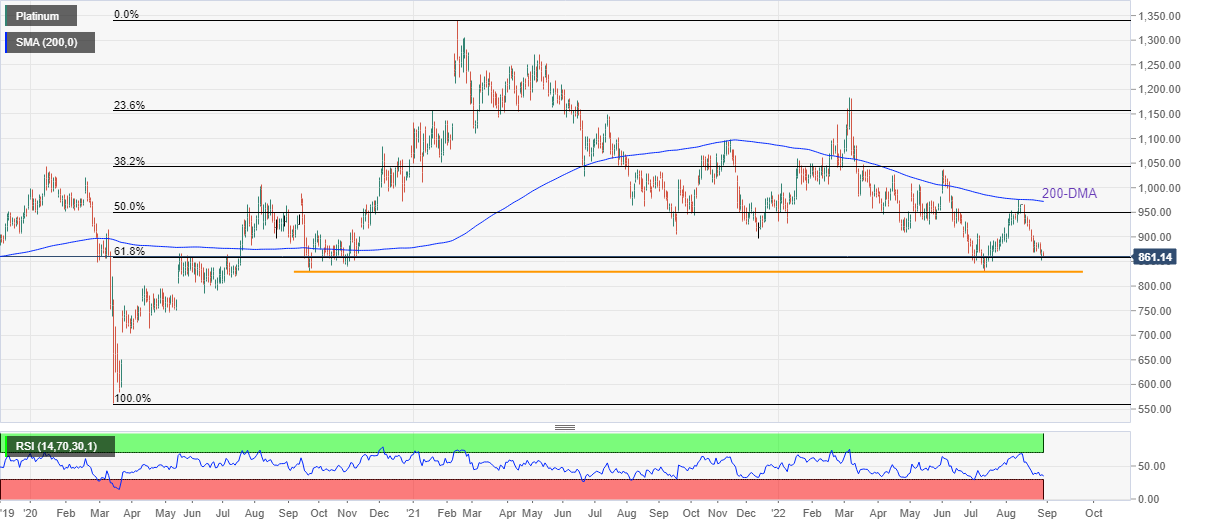

- Platinum price fades bounce off six-week low as sellers keep reins below 200-DMA.

- 61.8% Fibonacci retracement lures bears ahead of the key 23-month-old horizontal support.

- Nearly oversold RSI hints at limited downside room.

Platinum price (XPT/USD) holds lower grounds near $860 amid the early Tuesday morning in Europe. That said, the precious metal bounced off a 1.5-month low the previous day but couldn’t keep buyers on the board.

Given the quote’s sustained weakness below the 200-DMA, around $972.00 by the press time, XPT/USD is likely to remain pressured around the 61.8% Fibonacci retracement level of March 2020 to February 2021 upside, near $858.00.

In a case where bears manage to conquer the $858.00 support, the horizontal area comprising lows marked during September 2020 and in July 2022 could challenge the platinum bears around $830-29.00.

It should be noted that the XPT/USD south-run past $830.00 could make it vulnerable to breaking the $800 threshold while targeting June 2020 lows around $784.00.

Meanwhile, recovery remains elusive until the quote stays below the 200-DMA level surrounding $972.00, a break of which will propel the quote towards the $1,000 psychological magnet.

Even so, nearly oversold RSI might trigger the XPT/USD rebound targeting April’s swing low near $910.00.

To sum up, platinum is likely to remain on the bear’s radar unless crossing the 200-DMA. However, RSI approaches oversold territory and hints at a limited downside room.

Platinum: Daily chart

Trend: Limited downside expected