- US dollar bears are lurking, significant move shaping up

Market news

US dollar bears are lurking, significant move shaping up

- US dollar is strong in the Asian market but bulls are running into a key hourly resistance.

- The focus is on the NFP at the end of the week.

The US dollar has been pressured against a basket of peer currencies midweek, but the greenback is on track for its third-straight monthly rise as investors position for a sizeable interest rate hike from the US Federal Reserve.

The dollar index, DXY, which measures the greenback against a basket of six currencies, was last up 0.13% at 108.83, albeit down from Monday's two-decade peak of 109.48. Nevertheless, the index is on track for a rise of over 3% in August, and its highest end-of-month closing level since May 2002.

US Treasury yields have been bolstered by record-high inflation in parts of the world and the compounding recession fears have served as a bullish landscape for the greenback. The two-year US Treasury yield, which is relatively more sensitive to the monetary policy outlook in the US, hit a 15-year high at 3.499% overnight but eased back towards 3.446% by the close of play. The 10-year Treasury yield, which hit a two-month high of 3.153% but was moving in on the 3.2% mark in early Asia, supporting the greenback.

Traders are now pricing in about a 70% chance of a 75 basis points Fed rate hike next month, according to data from Refinitiv following Fed officials reiterating their support for further rate hikes. New York Fed President John Williams told Wall the Wall Street Journal that inflation expectations in the US were well anchored but added that it would take a few years to bring inflation back to 2%. Richmond Federal Reserve Bank President Thomas Barkin explained on Tuesday that the United States is facing "post-war-like" inflation.

Meanwhile, from a technical stance, however, if the bears commit today in Tokyo's and London's sessions, this could be the catalyst for a major turnaround in the greenback as we head into the Nonfarm Payrolls on Friday. The analysts at TD Securities explained that ''employment likely continued to advance robustly in August but at a more moderate pace following the booming 528k print registered in July. High-frequency data, including Homebase, point to still above-trend job creation.'' The analysts also look for the UE rate to drop by a tenth for a second consecutive month to 3.4%, and for wage growth to advance at a firm 0.4% MoM (5.3% YoY).

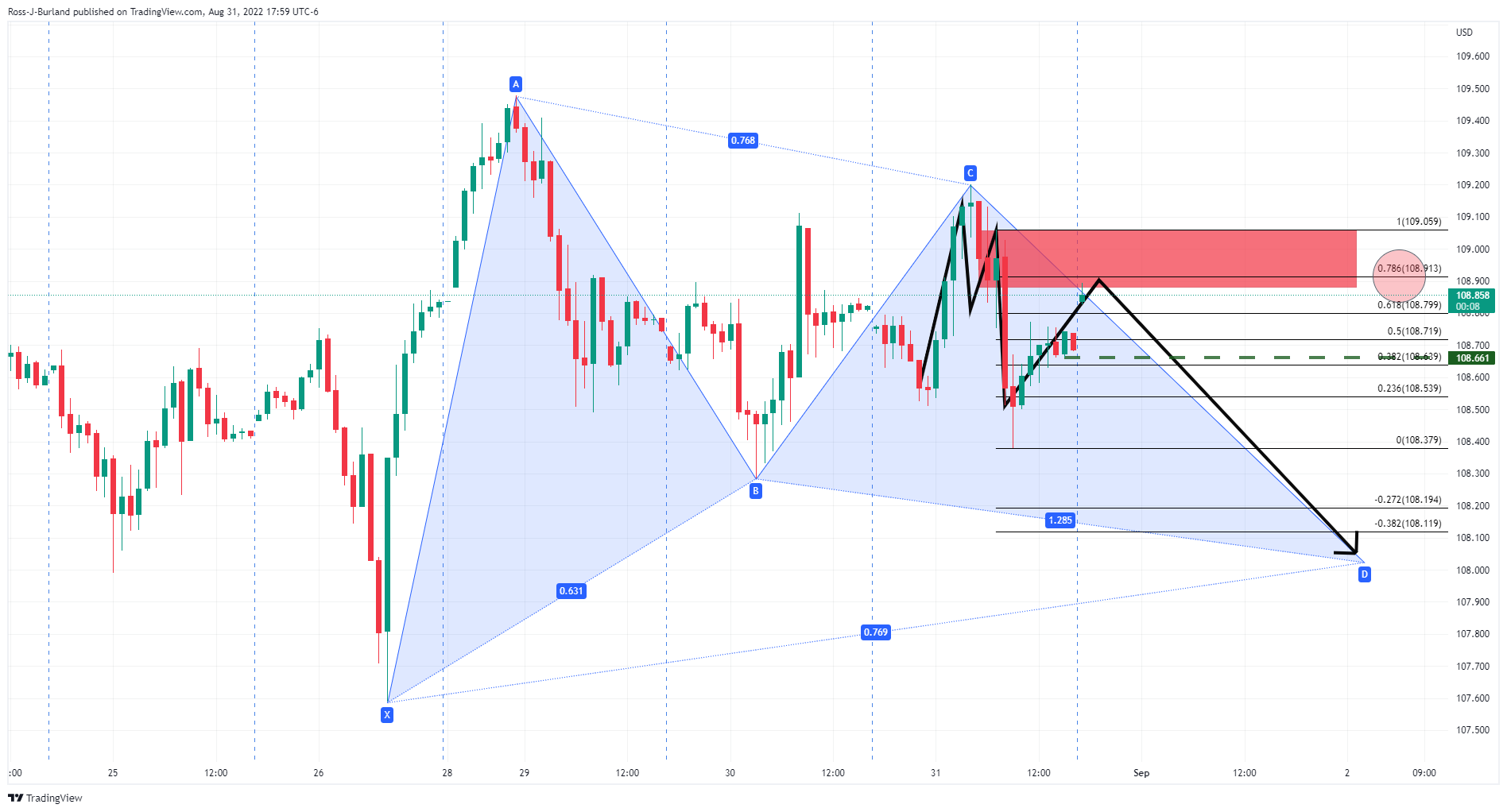

DXY hourly chart

The M-formation has drawn the price into the neckline and near a 78.6% Fibonacci retracement level, but if resistance were to hold, there would be prospects of a bearish move to complete a Gartley pattern. The key support is 108.6610 in that regard.