- EUR/USD extends gains north of parity on NFP

Market news

EUR/USD extends gains north of parity on NFP

- EUR/USD remains bid above the parity level on Friday.

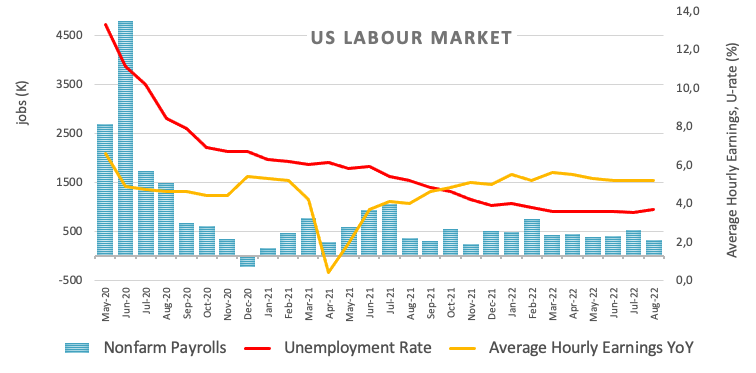

- US Nonfarm Payrolls rose by 315K jobs in August.

- The unemployment rate ticked higher to 3.7%.

EUR/USD keeps the daily bid bias unchanged and manages to retest the 1.0030 region in the wake of the release of Nonfarm Payrolls for the month of August.

EUR/USD looks well supported near 0.9900

EUR/USD keeps the positive stance on Friday after the release of the Nonfarm Payrolls showed the US economy added 315K jobs during August, surpassing initial estimates for a gain of 300K jobs. The July reading was revised down slightly to 526K (from 528K).

Further data saw the Unemployment Rate edge higher to 3.7% (from 3.5%) and the key Average Hourly Earnings – a proxy for inflation via wages – rise 0.3% MoM and 5.2% from a year earlier. Additionally, the Participation Rate, improved a tad to 62.4% (from 62.1).

Next on the US docket will come July’s Factory Orders.

EUR/USD levels to watch

So far, the pair is gaining 0.67% at 1.0013 and further upside could retest 1.0090 (weekly high August 26) ahead of 1.0202 (high August 17) and finally 1.0203 (55-day SMA). On the flip side, the breach of 0.9899 (2022 low August 23) would target 0.9859 (December 2002 low) en route to 0.9685 (October 2022 low).