- USD/CAD Price Analysis: Bullish correction playing out with focus on 1.3130 key resistance

Market news

USD/CAD Price Analysis: Bullish correction playing out with focus on 1.3130 key resistance

- USD/CAD may face resistance near 1.3130 which puts an emphasis o the downside.

- Beyond 1.3130, there are prospects of a move into 1.3150/75.

USD/CAD lost its footing on Wednesday as risk sentiment improved, knocking the US dollar off its bull cycle highs while the Bank of Canada hiked rates by 75 basis points. This has seen the technical outlook a touch less bullish than it was the prior day as the following illustrates.

USD/CAD H4 chart

The M-formation is a reversion pattern that would be expected to see the price revert into the neckline between a 38.2% Fibonacci and a 50% mean reversion area of around 1.3150.

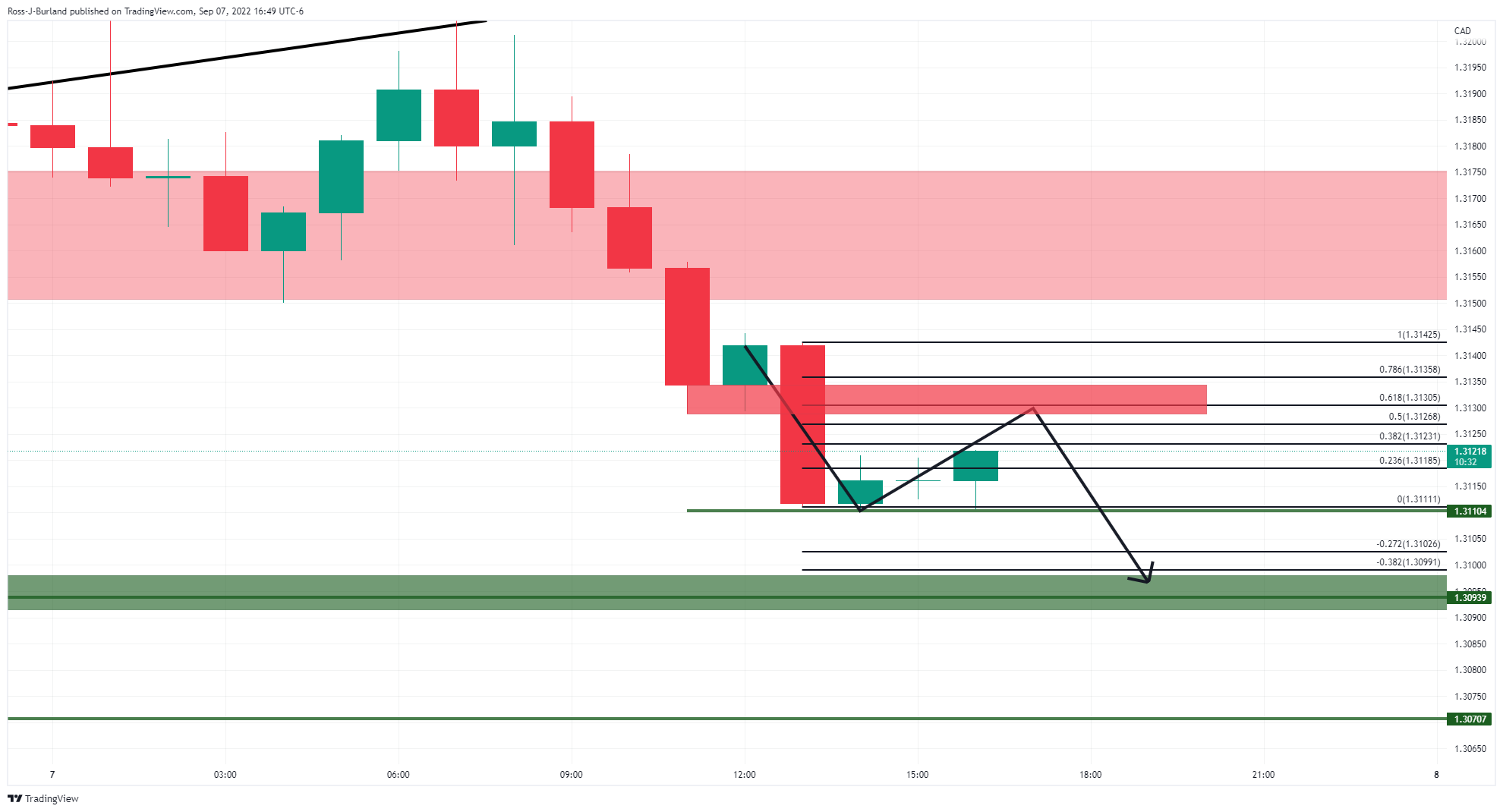

USD/CAD H1 chart

With that being said, the lower time frame price action is less bullish given the potential resistance up ahead near 1.3130 where prior support falls in near a 61.8% Fibonacci retracement of the prior bearish impulse on the hourly chart. A break below 1.31 opens risk of a test and break below 1.3070.