- Crude Oil Futures: Scope for a deeper retracement

Market news

8 September 2022

Crude Oil Futures: Scope for a deeper retracement

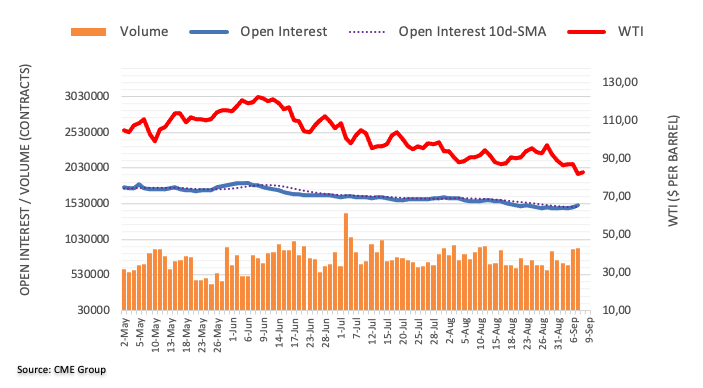

CME Group’s flash data for crude oil futures markets noted traders increased their open interest positions for the third session in a row on Tuesday, this time by around 31.2K contracts, the largest daily build since May 26. Volume, in the same line, rose by around 18.5K contracts, adding to the previous build.

WTI: Another test of $80.00 is possible

WTI prices dropped markedly on Wednesday and returned to levels last seen in late January in the sub-$82.00 area. The sharp move was amidst rising open interest and volume, leaving the door open to a probable deeper pullback to the key $80.00 mark per barrel in the short-term horizon.

Market Focus

Open Demo Account & Personal Page