- EUR/GBP Price Analysis: Renews 18-month high above 0.8700 after UK Retail Sales

Market news

EUR/GBP Price Analysis: Renews 18-month high above 0.8700 after UK Retail Sales

- EUR/GBP jumps to the highest levels since February 2021 on downbeat UK Retail Sales.

- UK Retail Sales dropped below market forecast and prior in August.

- Three-month-old previous resistance line limits immediate downside moves.

- Buyers approach an upward-sloping trend line from December 2021.

EUR/GBP portrays the market’s disappointment with the UK’s Retail Sales data during Friday’s early morning in Europe. The cross-currency pair takes the bids to refresh the 18-month high following that downbeat UK data.

UK’s Retail Sales for August marked 5.4% YoY contraction versus -4.2% expected and -3.4% prior. Details suggest that the Retail Sales ex-Fuel printed -5.0% the figure compared to -3.4% market consensus and -3.1% (revised down) previous readings.

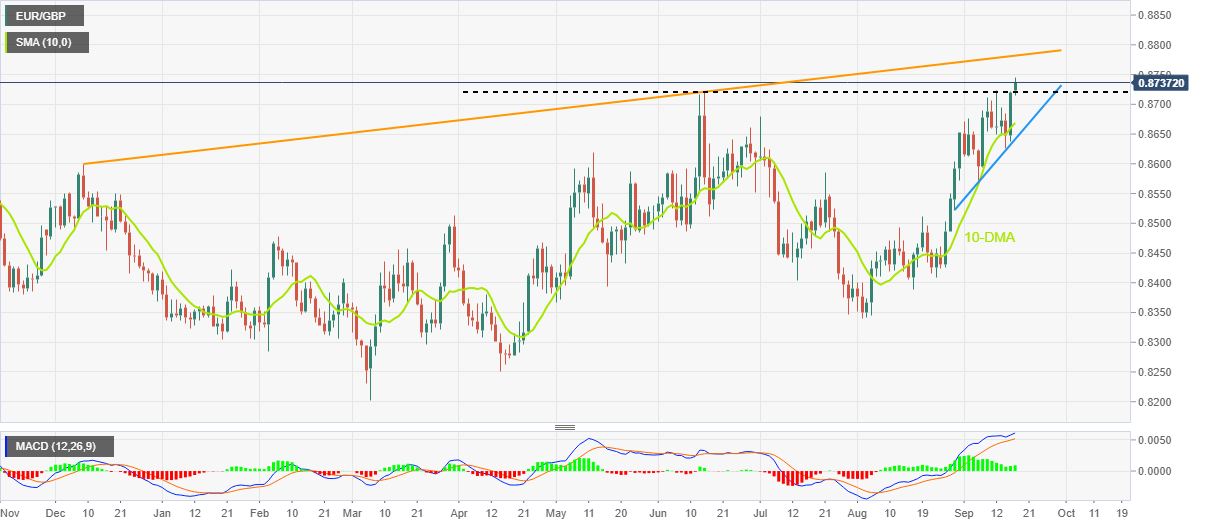

Following the data, EUR/GBP crossed the three-month-old horizontal hurdle surrounding 0.8720-25.

The resistance breakout also takes clues from the bullish MACD signals to direct the pair buyers towards an upward sloping resistance line from December 2021, around 0.8780 by the press time.

Meanwhile, pullback moves need to break the resistance-turned-support near 0.8725-20 to recall the EUR/GBP sellers.

Even so, the 10-DMA and a two-week-old ascending support line, respectively near 0.8665 and 0.8640, could challenge the pair’s further downside.

EUR/GBP: Daily chart

Trend: Further upside expected