- Gold Price Forecast: XAU/USD downside remains compelling amid hawkish Fed – Confluence Detector

Market news

Gold Price Forecast: XAU/USD downside remains compelling amid hawkish Fed – Confluence Detector

- Gold price is holding steady, as the dust settles after the central banks’ bonanza.

- Escalating geopolitical tensions cushion the downside in the yellow metal.

- XAU/USD’s path of least resistance appears down amid strong resistance levels.

With the central banks’ decisions out of the way, Gold price is treading water above $1,650, as the dust settles after another volatile week. Investors now assess odds for the next Fed move while awaiting a fresh batch of economic data. Meanwhile, the US dollar licks its wounds following the USD/JPY collapse-led sharp correction while the Treasury yields hover near multi-year tops, limiting the upside in the non-yielding bullion. Major global central banks have maintained that more rate increases are needed to tame inflation. This guidance has kept the bright metal reeling near two-year lows of $1,654. On the other side, escalating tensions between Russia and the West over the Ukraine crisis has provided a floor to the traditional safety net, gold. However, it remains to be seen if the metal can defend the $1,650 support level going forward.

Also read: Gold Price Forecast: Sellers keep defending the $1,680 price zone

Gold Price: Key levels to watch

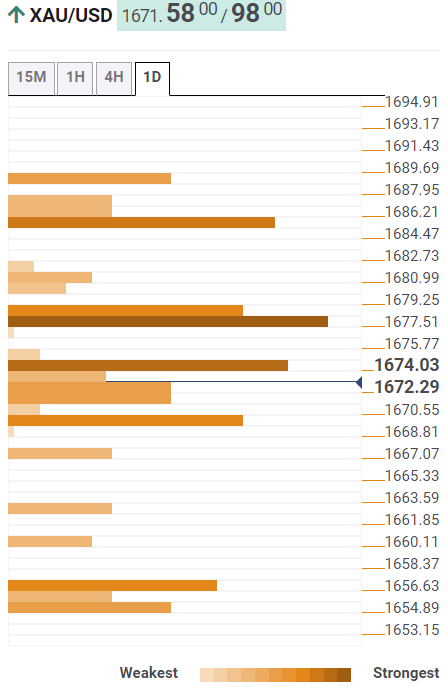

The Technical Confluence Detector shows that the gold price is facing stiff resistance at $1,674, the intersection of the Fibonacci 61.8% one-day and the Fibonacci 23.6% one-week.

The previous year’s low at $1,677 will be the next stop for XAU buyers, above which the SMA50 four-hour at $1,680 could offer minor resistance.

The confluence of the previous day’s high and the Fibonacci 38.2% one-week at $1,685 will be a tough nut to crack for bulls.

On the flip side, the SMA10 four-hour at $1,669 will guard the immediate downside, below which the Fibonacci 38.2% one-day at $1,667 will come into play.

Further down, the Fibonacci 23.6% one-day at $1,663 will challenge the bullish commitments.

The line in the sand for gold optimists is aligned at the convergence of the previous day’s low and pivot point one-day S1 at $1,656.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.