- USD/CHF Price Analysis: Emerging inverse head-and-shoulders pattern in the daily, targets 1.0370

Market news

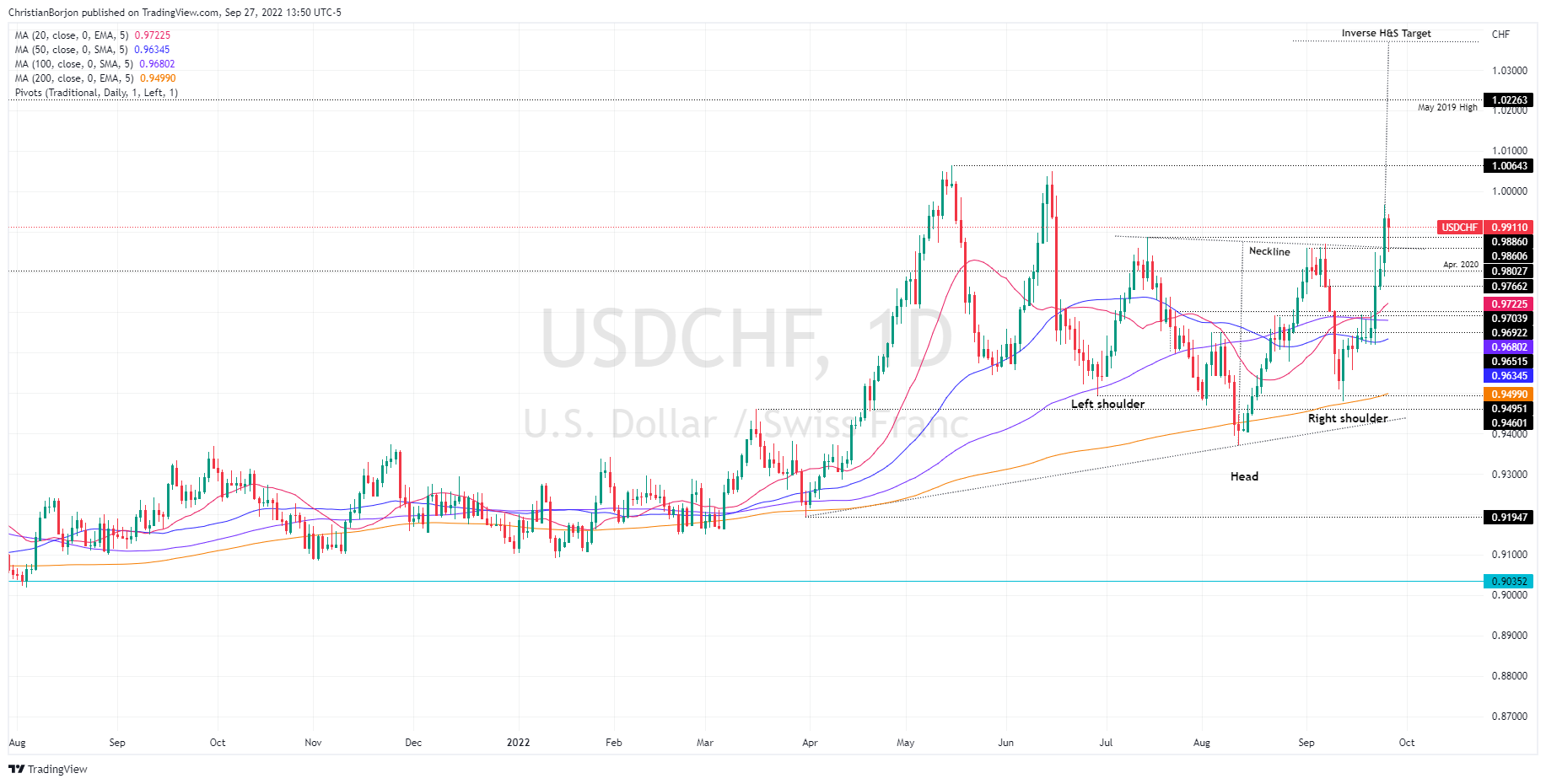

USD/CHF Price Analysis: Emerging inverse head-and-shoulders pattern in the daily, targets 1.0370

- The USD/CHF cuts some of its Tuesday’s losses, down 0.18% during the session.

- Once the USD/CHF broke above the 0.9900 figure, it paved the way for a parity re-test.

- An inverse head-and-shoulders in the USD/CHF daily targets 1.0370.

The USD/CHF is trimming some of the day’s earlier losses, bouncing off daily lows around 0.9849 and climbing above the 0.9900 figure, for the second consecutive day, as sentiment shifts negative, with the S&P 500 hitting a new two-year low during the day. At the time of writing, the USD/CHF is trading at 0.9913, slightly down by 0.18%.

USD/CHF Price Analysis: Technical outlook

The USD/CHF daily chart portrays the major as upward biased, further cementing its bias once it clears the July 14 swing high at 0.9886. Earlier in the day, USD/CHF sellers tried to reclaim the latter, but buying pressure overcame sellers, and the USD/CHF edged above the 0.9900 threshold. It should also be noted that an inverse head-and-shoulders chart pattern is emerging, which could pave the way for further gains.

If the USD/CHF breaks above parity, that could put in play the YTD high at 1.0064. Once cleared, the next resistance level would be the 1.0100 figure, followed by the May 2019 swing high at 1.0226, ahead of the inverse head-and-shoulders target at 1.0369.

USD/CHF Key Technical Levels