- EUR/USD Price Analysis: Bears chip away at fresh lows, eye 0.9700

Market news

EUR/USD Price Analysis: Bears chip away at fresh lows, eye 0.9700

- EUR/USD bears eye a run to test 0.9700 territory.

- The euro remains under pressure as the US dollar picks up an early bid.

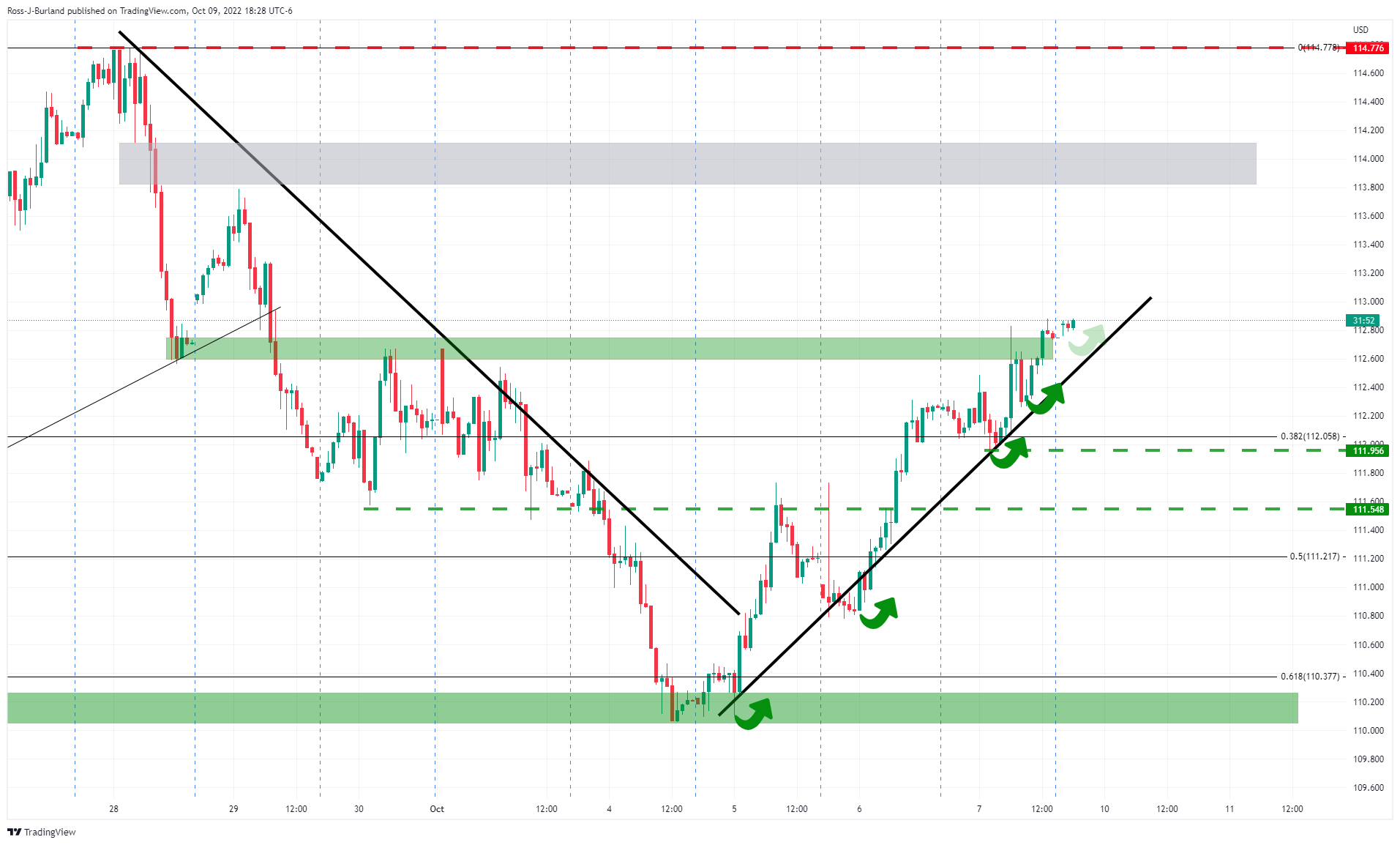

The US dollar remains in favour of the bulls at the start of the week as the following hourly DXY chart illustrates:

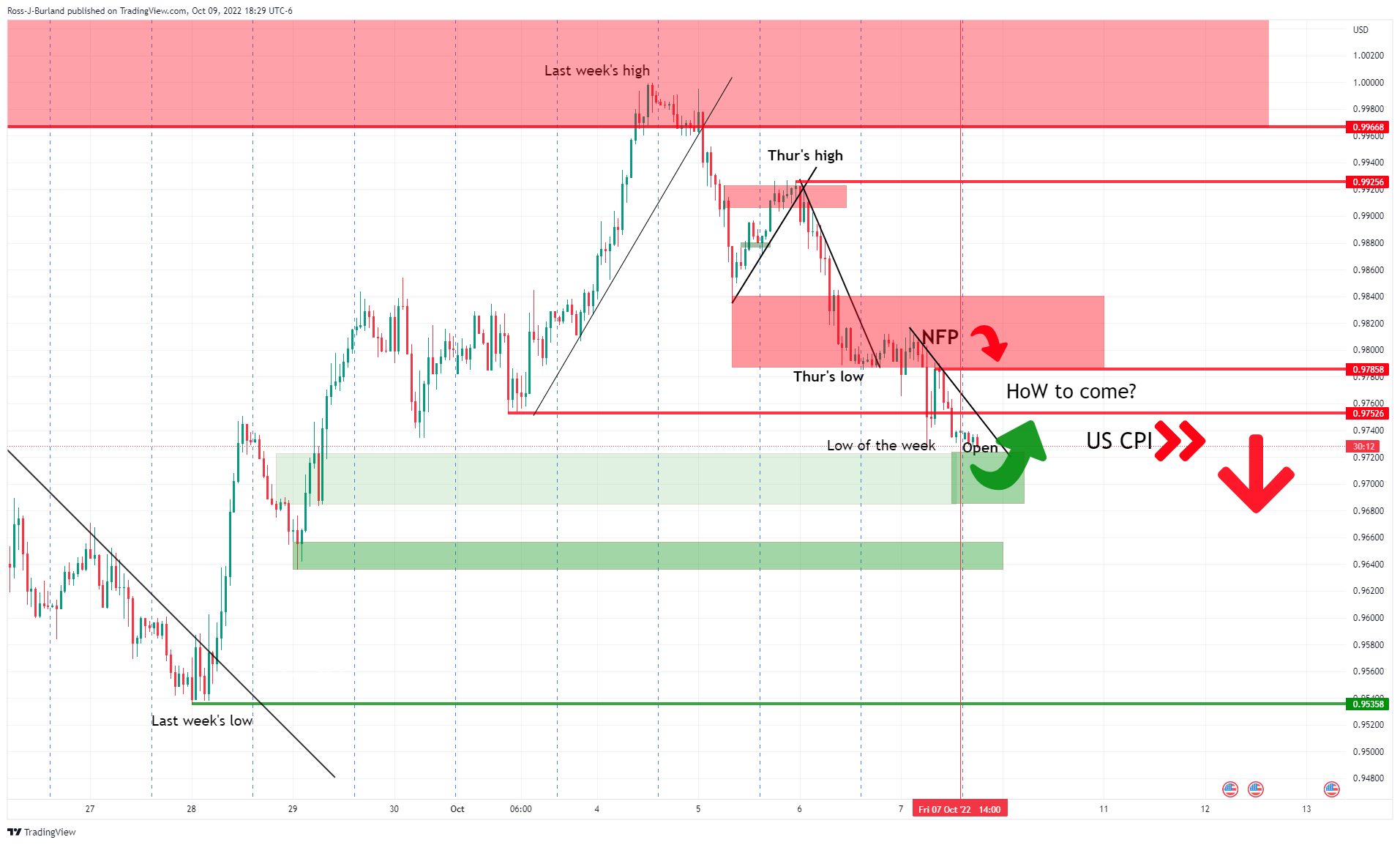

The price of EUR/USD will all depend on the outcome of the US Consumer Price Index for the main event of this week. For the time being, the euro might find some relief but it needs to break up out of the trendline resistance that has formed on the back of Nonfarm Payrolls Friday.

EUR/USD H1 chart

The Support of the late September business is playing its role, so far. However, any pullbacks above the dynamics resistance could come into resistance below the NFP highs which could result in the High of the Week (HoW) as illustrated on the chart above. A downside continuation, thereafter, could be on the cards as per the following daily chart:

EUR/USD daily chart

The daily chart shows the price descending in the bearish channel without any signs of deceleration. The M-formation is however a reversion pattern and the neckline, at some stage, would be expected to come back under pressure to the upside neat 0.9800. However, it would appear that 0.9700 is at the front of the queue in that regard.