- GBP/USD Price Analysis: Bounces off five-week-old support ahead of BOE

Market news

GBP/USD Price Analysis: Bounces off five-week-old support ahead of BOE

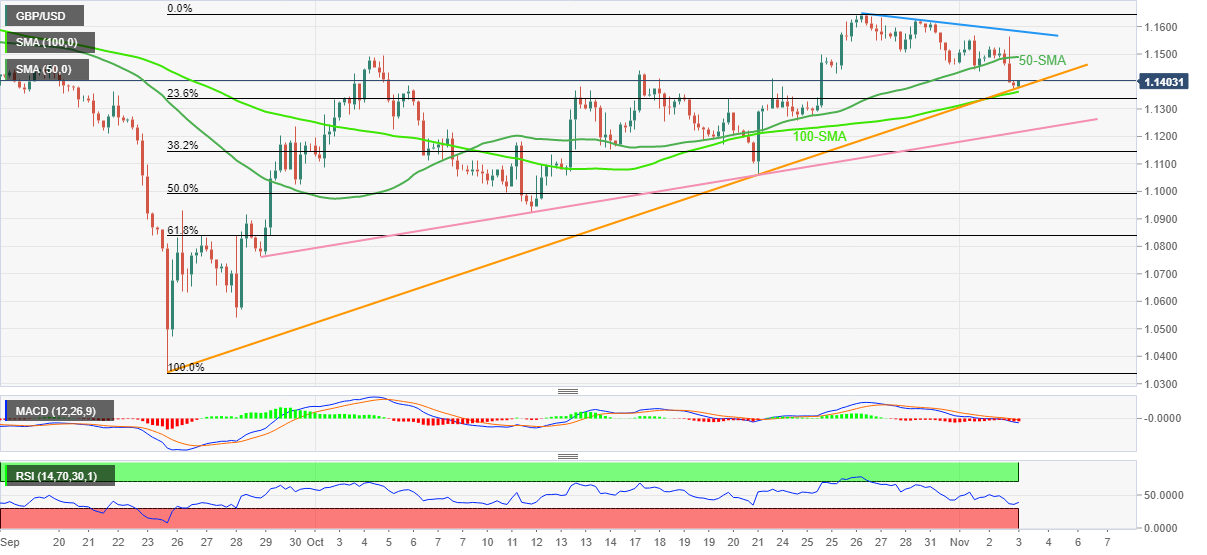

- GBP/USD seesaws around seven-day low as the key support line challenge sellers.

- Bearish MACD signals, descending RSI line joins 50-SMA breakdown to favor sellers.

- 100-SMA, ascending trend line from late October adds to the downside filters.

- Bulls need to cross weekly resistance line to retake control.

GBP/USD licks its wound around a one-week low as a short-term key support trend line challenge bears near 1.1380 during early Thursday.

Even so, the bearish MACD signals and a clear downside break of the 50-SMA keep the pair sellers hopeful. Also suggesting the quote’s further decline is the absence of the oversold RSI (14).

In addition to the immediate support line surrounding 1.1380, the 100-SMA level near 1.1360 also challenges the GBP/USD bears.

Should the quote drops below 1.1360 SMA support, its fall to an upward-sloping trend line from September 29, at 1.1215 appears imminent.

It’s worth noting that the GBP/USD pair’s sustained weakness past 1.1215 will make it vulnerable to approaching the late October swing low of 1.1060.

Meanwhile, recovery moves may initially aim for the 50-SMA hurdle surrounding 1.1490 before eyeing the 1.1500 threshold.

Following that, a one-week-old descending resistance line, near 1.1580 by the press time, becomes crucial to recall GBP/USD buyers.

That said, the cable pair’s successful trading beyond 1.1580 could quickly approach the previous monthly top of 1.1640 before directing the bulls to September’s high around 1.1740.

Also read: GBP/USD bears attack 1.1400 support on FOMC showdown, BOE’s “Super Thursday” eyed

GBP/USD: Four-hour chart

Trend: Further downside expected