- Gold Price Forecast: XAU/USD bears gear up for a test of $1,617 ahead of US NFP – Confluence Detector

Market news

Gold Price Forecast: XAU/USD bears gear up for a test of $1,617 ahead of US NFP – Confluence Detector

- Gold price is resuming its Fed-induced downside, as US dollar bulls regain traction.

- Markets remain risk averse amid aggressive Fed rate hike bets, ahead of US NFP.

- XAU/USD path of least resistance appears down, with eyes on Oct lows at $1,617.

Gold price has erased early recovery gains and resumes its bearish momentum for the second straight day this Thursday. The US dollar regains upside traction, riding higher on the hawkish Fed outlook wave. The world’s most powerful central bank delivered on the expected 75 bps rate hike on Wednesday while Fed Chair Jerome Powell stuck with his resolve to bring down inflation by noting that more rate increases are needed and the ‘ultimate level’ of rates are likely higher than earlier estimates. The dollar staged a solid comeback in tandem with the Treasury yields, weighing heavily on the bright metal. Traders now await the BoE rate hike announcements, which are likely to underscore the Fed-BoE policy contrast, adding to the ongoing dollar strength while exacerbating the pain in XAU/USD. The next of relevance for the bullion remains Friday’s US Nonfarm Payrolls release for further hints on the Fed’s next rate hike move.

Also read: Gold Price Forecast: For how long can XAUUSD hold $1,630 support? BOE in focus

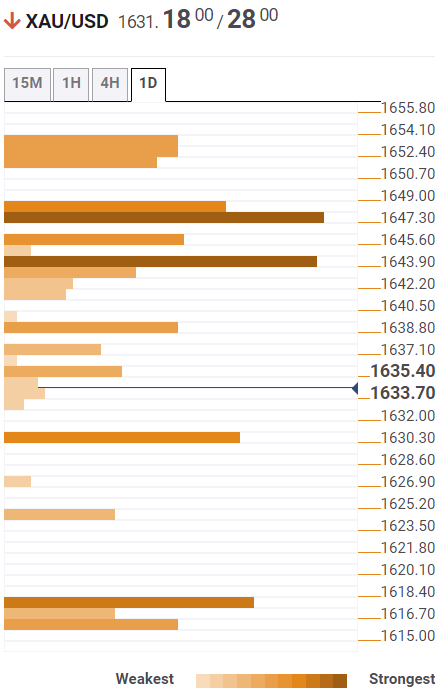

Gold Price: Key levels to watch

The Technical Confluence Detector shows that the gold price is challenging the critical $1,630 support, which is the pivot point one-week S1.

A fresh drop towards the pivot point one-day S1 at $1,624 remains in the offing. Further down, sellers will aim for the October month low at $1,617. At that level, the pivot point one-week S2 hangs around.

Alternatively, the immediate resistance is seen at the previous day’s low at $1,635, above which the previous week’s low at $1,638 will be tested.

A firm break above the latter will kickstart a renewed upswing in the bullion, with the Fibonacci 23.6% one-month and one-day at $1,643 on buyers’ radars.

The next powerful upside hurdle is aligned at $1,648, where the SMA10 one-day, Fibonacci 38.2% one-day and Fibonacci 23.6% one-week merge.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.