- EURJPY Price Analysis: Bulls approach 147.00 hurdle with eyes on yearly high

Market news

EURJPY Price Analysis: Bulls approach 147.00 hurdle with eyes on yearly high

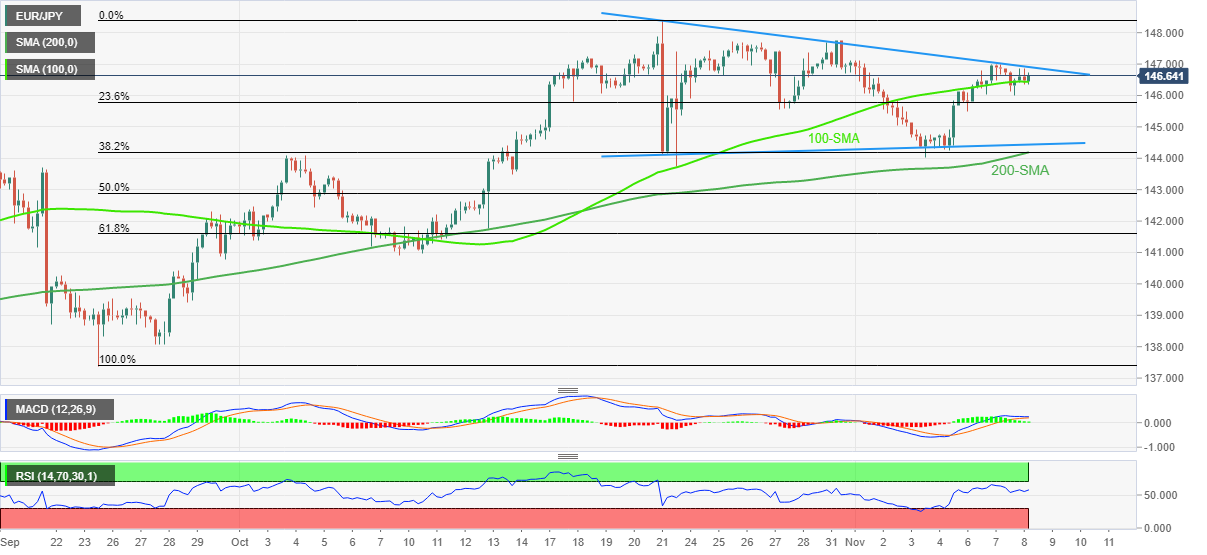

- EURJPY rebounds from 100-SMA inside a 13-day-old symmetrical triangle.

- MACD teases bears but firmer RSI, sustained trading beyond 200-SMA favor buyers.

- 2014’s yearly peak could lure the bulls past October’s high.

- 200-SMA, 144.00 could challenge short-term bears ahead of giving them control.

EURJPY picks up bids to reverse the previous day’s pullback from sub-147.00 resistance during Wednesday’s Asian session. In doing so, the cross-currency pair bounces off the 100-SMA while poking the resistance line of a two-week-old symmetrical triangle, around 146.70 by the press time.

Although the MACD signals are less bullish, the firmer RSI (14) and the quote’s sustained trading beyond the 200-SMA keep the EURJPY bulls hopeful to overcome the 147.00 resistance level.

The same could allow the pair buyers to refresh the yearly high, currently around 148.40.

In that case, the year 2014 high near 149.80 and the 150.00 round figure will gain major attention.

Alternatively, pullback moves need a downside break of the 100-SMA level surrounding 146.45 to tease the pair sellers.

Even so, support line of the aforementioned triangle, near 144.50, could challenge the EURJPY downside.

It’s worth noting that the 200-SMA and early October’s high, respectively near 144.20 and 144.00, could act as additional downside filters for the pair traders to watch before welcoming the bears.

Overall, EURJPY remains on the bull’s radar and aims to refresh the yearly high.

EURJPY: Four-hour chart

Trend: Further upside expected