- EURUSD jumps past 1.0150 on lower US CPI

Market news

EURUSD jumps past 1.0150 on lower US CPI

- EURUSD rises to 2-month highs near 1.0160 on Thursday.

- The dollar plummets following lower-than-expected US inflation.

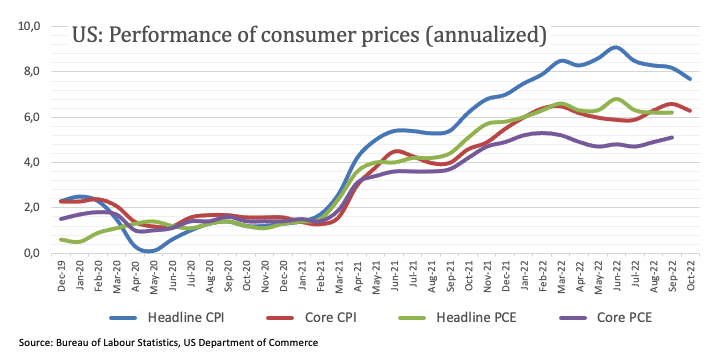

- US headline CPIP rose 0.4% MoM in October and 7.7% YoY.

EURUSD saw its downside abruptly reversed and quickly climbed to the 1.0160 region in the wake of the release of US inflation figures.

EURUSD jumped to multi-week highs post-CPI

EURUSD regains upside traction on the back of the collapse in the dollar after US inflation figures rose less than estimated in October. Indeed, inflation measured by the headline CPI rose 0.4% MoM in October and 7.7% over the last twelve months. Additionally, the Core CPI advanced 6.3% from a year earlier, also below initial expectations.

The greenback, in the meantime, rapidly breaks below the 109.00 support and trades in levels last seen back in mid-September in the 108.70/65 band.

Adding to the U-turn in the buck, US yields dropped to fresh multi-session lows pari passu with increasing speculation of a potential Fed’s pivot in the near term.

What to look for around EUR

EURUSD accelerates the upside and now refocuses on the next target of note near the 1.0200 mark, or September peaks.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. The recent decision by the Fed to hike rates and the likelihood of a tighter-for-longer stance now emerges as the main headwind for a sustainable recovery in the pair.

Furthermore, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the fragile sentiment around the euro in the longer run.

Key events in the euro area this week: Italy Industrial Production (Thursday) – Germany Final Inflation Rate (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EURUSD levels to watch

So far, the pair is advancing 1.07% at 1.0115 and faces the next up barrier at 1.0159 (monthly high November 8) seconded by 1.0197 (monthly high September 12) and finally 1.0368 (monthly high August 12). On the other hand, a breach of 0.9730 (monthly low November 3) would target 0.9704 (weekly low October 21) en route to 0.9631 (monthly low October 13).