- AUD/USD bears take on a critical area of support

Market news

AUD/USD bears take on a critical area of support

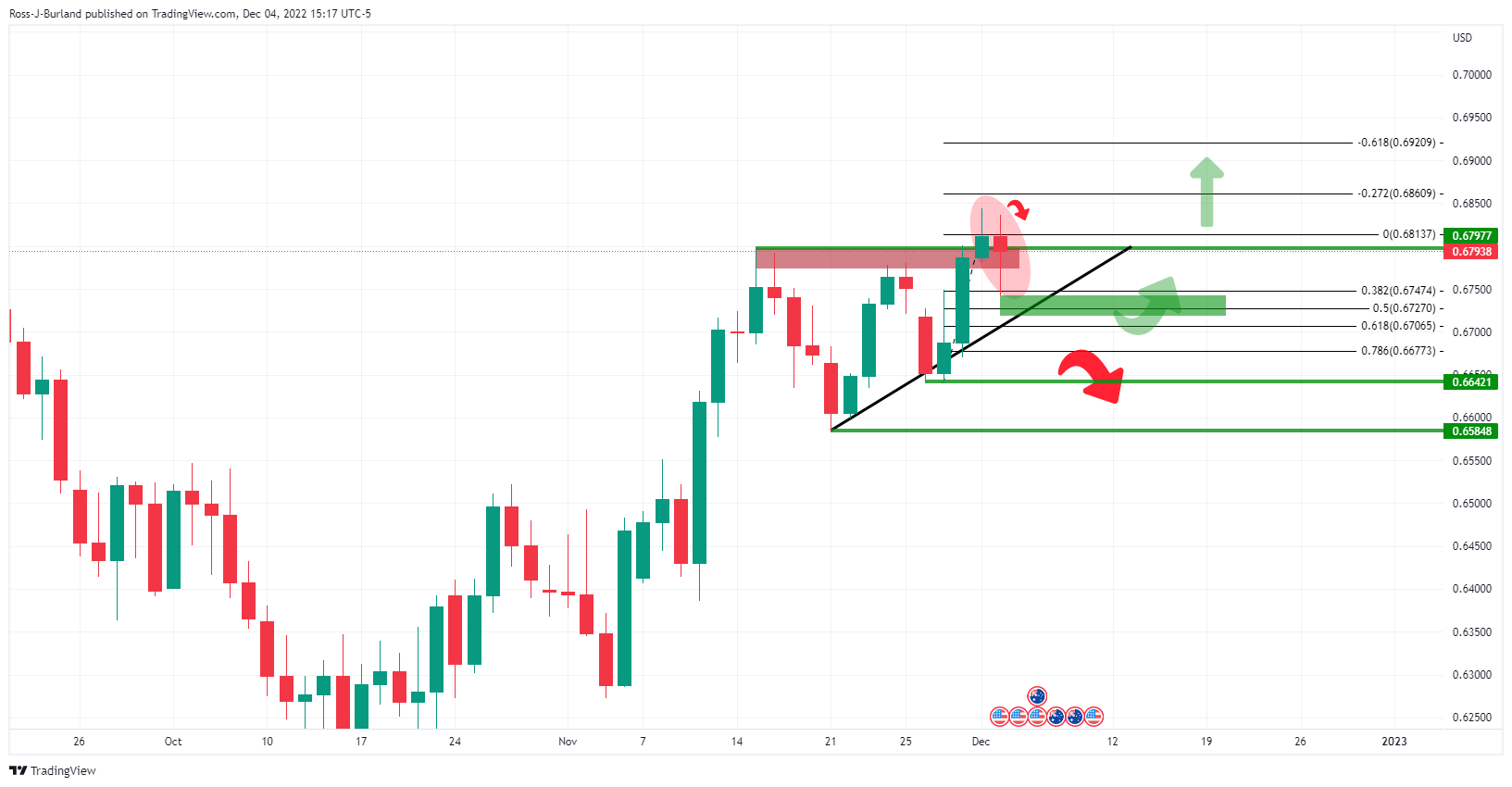

- AUD/USD dropped to test a key technical area on the daily chart.

- AUD/USD bears eye a test below the trendline and a move below 0.6640/50 could be significant.

AUD/USD was under pressure and down by some 0.14% into the close on Wall Street following the prior day's Reserve Bank of Australia, RBA, meeting within a risk-off environment in financial markets.

The RBA delivered a 25bps hike as expected but stopped short of signalling a pause as some forecasters were anticipating. The RBA said it was not on a preset course to tighten policy but said inflation was still high. The Bank reaffirmed its tightening bias, noting a further increase in inflation and wages. Meanwhile, today’s Gross Domestic Product (GDP) data for Australia is expected to show growth of 0.7% QoQ with annual GDP growth expected to increase to 6.3%.

As for the greenback, it was nearly unchanged on Tuesday after strong gains the day before, in a risk-off environment. Data this week showed that the Institute for Supply Management (ISM) said its Non-Manufacturing PMI rose to 56.5 last month from 54.4 in October, indicating that the services sector, which accounts for more than two-thirds of US economic activity, remained resilient in the face of rising interest rates.

This data combined with Friday's surprisingly strong Nonfarm Payrolls and wage growth data in November as well as news that consumer spending had accelerated in October raised optimism that a recession could be avoided in 2023. Consequently, traders currently expect a half-point hike from the Fed next week and they expect a terminal rate of just above 5% in May.

AUD/USD technical analysis

As per the prior analysis, AUD/USD Price Analysis: Eyes are on critical daily dynamic support, where a 50% mean reversion area was eyed in the lower quarter of the 0.6700s, bears have moved in as follows:

Prior analysis:

AUD/USD update

Should the supporting trendline be broken now, a move below 0.6640/50 could be a significant bearish development ahead of the critical remaining calendar events for the year.